news

Breaking : Tinubu signs $10 billion Executive Order to unlock fresh investment in oil and gas, Says Gbajabiamila

President Bola Tinubu said on Tuesday, April 30, that he recently signed an Executive Order that to unlock about $10 billion in fresh investments in the nation’s oil and gas sector.

President Bola Tinubu said on Tuesday, April 30, that he recently signed an Executive Order that to unlock about $10 billion in fresh investments in the nation’s oil and gas sector.

Speaking at a opening of a two day retreat on economic transformation and development organised by the House of Representatives, the president said the development is expected to happen through Fiscal Incentives for Non-Associated Gas (NAG), Midstream and Deepwater Oil & Gas Developments.

Represented by his Chief of Staff, Femi Gbajabiamila, the president also disclosed that just last week, the Nigerian government signed the consolidated guidelines for implementing Fiscal Incentives for the Oil & Gas Sector.

According to him, the guidelines, which represent a cornerstone of the Presidential Directive, aim to enhance the Nigerian oil and gas sector’s global competitiveness while stimulating economic growth.

He said further that “the Executive Order also streamlines contracting processes, procedures, and timelines from 36 months to 6 months. The order also seeks to ensure that local content requirements are implemented without impeding investments or the cost competitiveness of oil and gas projects”.

Related to this, the President said are the reforms being implementing to the nation’s tax regimes to limit taxes collected without negatively affecting government revenues.

He said: “All of these have the same objective – to reduce government interference with the commercial imperatives of businesses in the country so that businesses based here can be competitive and focus on their core objectives of economic growth through innovation and trade.

“We will need the support of the National Assembly to fully implement some of these reforms, as statutory changes will be required in some areas.

“I am confident that when the time comes, the governing partnership we have established between the Executive and the Legislature will ensure that these changes are effected swiftly to benefit our nation.”

The president said despite the sceptics, the productive collaboration between the executive, the House, and the Senate has yielded significant results with the successfully passage of numerous bills aimed at enhancing the welfare of Nigerians.

He expressed appreciation to the leadership of the National Assembly for their swift action in considering and passing the Student Loans (Access to Higher Education) (Repeal and Reenactment) Act 2024.

He said: “Your actions have substantially fortified the legal framework of the Students Tertiary Education Loan Program, ensuring its efficient implementation. These achievements are a testament to the power of our partnership and the positive impact it can have on our nation.

“In a World Bank document titled “Legislative Oversight and Budgeting: A World Perspective,” Thomas Frederick Remington wrote “for legislators to effectively fulfil their roles of representation, oversight, and law-making, a certain level of cooperation between the Legislature and the Executive in policymaking is essential.

“The legislature must have the capacity to monitor the executive, and the executive, in turn, should be willing to comply with the legislative enactments.

“It is not just a coincidence but a strategic advantage for our country that the governing relationship between the Executive and the Legislature perfectly reflects this ideal.

“As you know, my administration is implementing significant policy changes to reform how we govern and position our country for progress and shared prosperity for all citizens.

“These reforms, while necessary and, in some cases, long overdue, are not without their challenges. I am deeply grateful for your unwavering support and understanding during these times. Your understanding and support have been invaluable, and I am confident that with our continued collaboration, we can overcome any challenges that lie ahead.

“The oil and gas industry has long been the lifeblood of our national economy. My administration is working tirelessly to change this and diversify our economy from overreliance on the production of fossil fuels. However, we are also determined to maximise revenue potential from this critical industry.

“For this reason, we are pushing policies to attract investment in the oil and gas sector”.

The President also said: “we can only justify our collective mandate and the trust our people repose in us through constructive collaboration between the National Assembly and the Executive. This joint effort is the minimum the people who voted for us expect from us.

“However, the very essence of checks and balances means there will be times when the executive and legislative prerogatives inevitably collide. Above all else, the national interest must guide our decisions in those moments. We share a common responsibility in shaping the future of our nation, and it is through our collaboration that we can effectively fulfil this duty.

In his address at the event, Speaker of the House of Representatives, Abbas Tajudeen said the House made a deliberate decision to focus on tax reforms and modernisation as well as a review of the implementation of the Petroleum Industry Reform Act (2021), adding that the overarching objective is to discuss and identify concrete legislative strategies for economic transformation.

The Speaker said further that the commitment and foresight shown by the government in addressing economic challenges deserve commendation, adding that “it is imperative that we, as legislators, align our efforts to support and enhance these endeavours.”

He said by designing and implementing progressive tax policies, the nation strive to ensure a fair and efficient tax system that boosts revenue while fostering economic growth and equity.

This, he said involves not only broadening the tax base and simplifying tax codes, but also enhancing compliance and minimising loopholes that benefit only the wealthy.

According to him, the retreat aims to foster stakeholder engagement, ensure constructive dialogue, exchange ideas and offer insights on legislative strategies that will contribute to the economic transformation of our country.

He said further that the retreat allows the lawmakers to take a deep dive into the tax reforms instituted by President Tinubu and undertake a review of the implementation of the Petroleum Industry Act (2021).

He said the House consider these two initiatives vital in our nation’s quest for economic recovery, transformation and growth. The two areas speak to both the oil and non-oil sectors of the Nigerian economy.

The Speaker lamented that Nigeria, Africa’s most populous nation, has long been grappling with issues related to tax collection and revenue generation with Nigeria’s general government revenue was recorded at 7.3 per cent of GDP, which is significantly lower than the average revenue of countries in the ECOWAS.

He said Nigeria’s fiscal revenue has declined, predominantly due to decreasing oil revenue over the last ten years, while non-oil revenue has remained stagnant at about 4-5 per cent of GDP.

He said further that Nigeria’s tax revenue struggles are primarily due to narrow bases for indirect taxes, low compliance rates among taxpayers, substantial tax exemptions, and generally low tax rates.

He said ‘This situation is compounded by a lack of enthusiasm and morale for tax compliance, contributing to the nation’s underwhelming fiscal performance. Comparatively, Nigeria’s efficiency in collecting Value Added Tax (VAT) is the lowest among its African peers, indicating significant inefficiencies in its tax system.

“This trend of low tax revenue, coupled with a continued dependency on the increasingly unstable oil revenue, presents a major risk to Nigeria’s fiscal sustainability. It also highlights an important area for potential reform to boost revenue and stabilise the country’s economic framework.

“The lack of growth in non-oil revenue sources and the volatile nature of oil income underscore the urgent need for Nigeria to diversify its revenue base and enhance its fiscal management to ensure economic stability and growth.”

He argued that several empirical studies have shown that Nigeria has the potential to further increase revenue if priority tax reforms are implemented, adding that the House stands ready to support the Executive to achieve its overall goal of reversing the negative trend.

Speaking on the Petroleum Industry Act, the Speaker said the PIA is not just a piece of legislation, but a transformative blueprint designed to overhaul the petroleum industry, which is the backbone of the nation’s economy.

According to him, if executed effectively and thoroughly, the PIA could set a benchmark for exemplary natural resource management that would involve distinct and defined roles within the industry subsectors, the establishment of a national petroleum company that is both commercially-oriented and profit-driven, and the incorporation of transparency, good governance, and accountability in managing Nigeria’s petroleum resources.

The law, he said would support the economic and social progress of host communities, ensure environmental remediation, and create a favourable business environment for oil and gas operations within the country.

Abbas said the realisation of these outcomes depends on the ability of the political and oil industry leaders to address several significant challenges, including interpretative challenges due to ambiguous language, which could lead to disputes and uncertainty in its implementation.

He stressed that the complexity of the law necessitates enhanced capacity building within new regulatory institutions to ensure effective interpretation and application, as well as efficient fund management.

He maintained that the National Assembly was vital in ensuring continuous review of the Petroleum Industry Act to ensure its effectiveness in a rapidly evolving industry landscape.

Deputy Speaker of the House, Benjamin Kalu said on Tuesday that Nigeria’s current tax system is suffering from inefficiency leading to some of the lowest tax collection rate in the world.

Kalu put the nation’s tax collection at about 10.8 percent of GDP, adding that the statistics is according to data from the Federal Inland Revenue Service (FIRS) and the National Bureau of Statistics (NBS).

He said these inefficiencies hinder the nation’s ability to invest in essential public services and infrastructure, adding that the role of the National Assembly, particularly the House of Representatives, is crucial in enacting reforms that broaden the tax base, simplify the tax code, and enhance compliance mechanisms without placing undue burdens on Nigerians.

He said “the role of the National Assembly, particularly the House of Representatives, in this process cannot be overstated.

“We are the custodians of the people’s will, entrusted with the responsibility of ensuring that the lofty ideals enshrined in the PIA are translated into tangible benefits for all Nigerians. “This retreat serves as a critical forum for us to collectively strategize on how to fulfill this vital mandate.”

Executive Chairman of the Federal Inland Service, Zack Adedeji said there must be collective effort and shared commitment for implementing collective tax reforms to empower citizens and ensure a resilient future.

Represented by the Director, Support Services Group, Mohammed Lawal Abubakar, Adedeji said the country has embarked on tax reforms to position tax administration ensuring transparency and accountability to enhance revenue and achieving revenue targets for economic development.

He added that the service has segmented tax payers into various categories for more effective tax administration and customers focused strategies to serve the country through innovative approaches.

He explained that the nation’s tax policy was hinges on both direct and indirect tax to optimize revenue collection and minimize leakages.

news

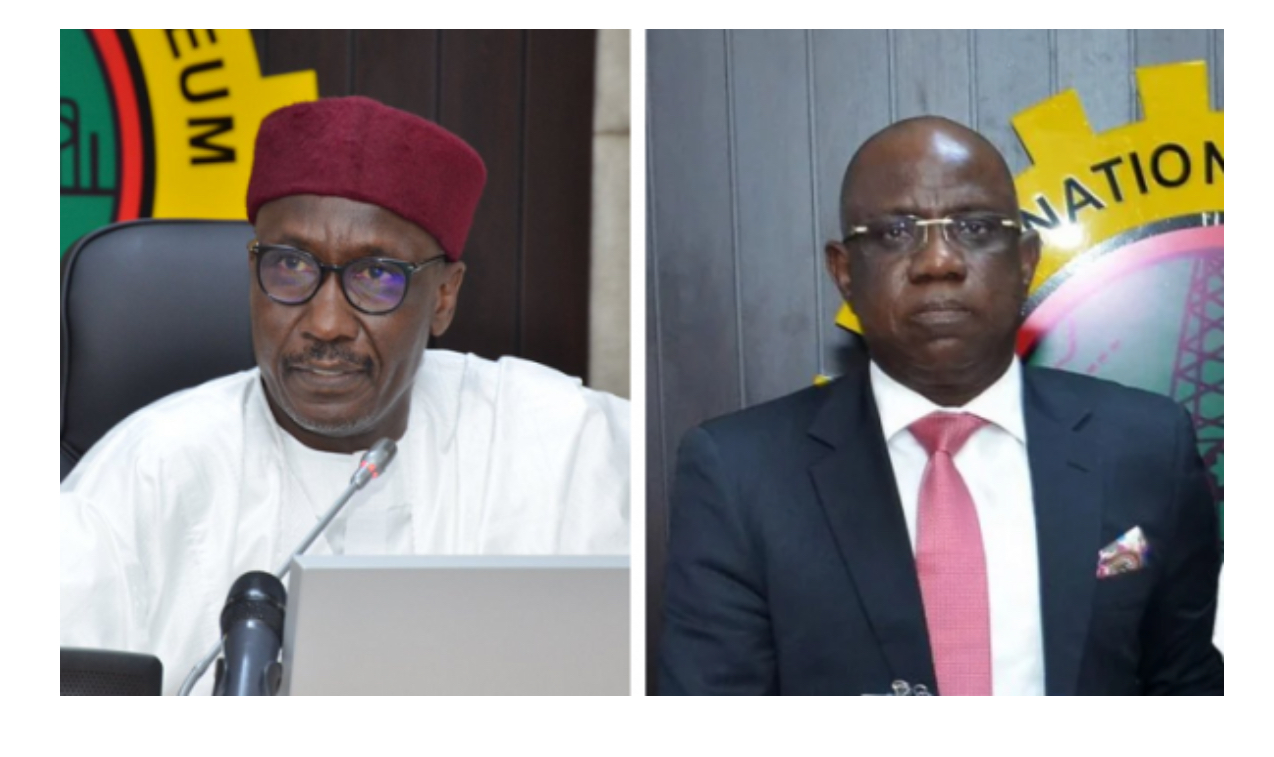

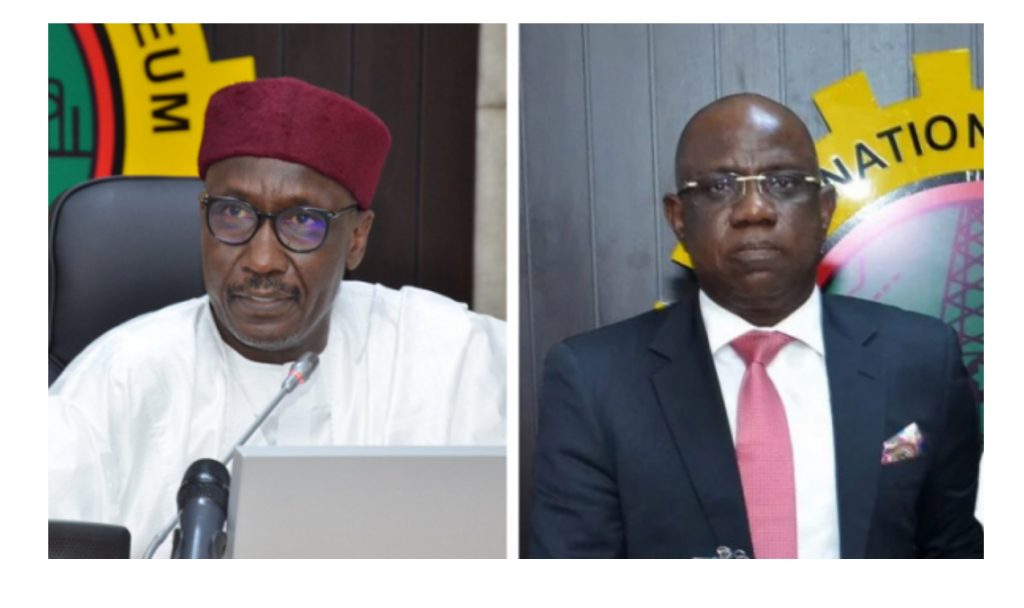

Breaking : TInubu appoints Bashir Ojulari as new CEO group of NNPC and GMD mele kyari get sacked, Says Onanuga

President Bola Tinubu has sacked the board of the Nigerian National Petroleum Company (NNPC) including its Group Chief Executive Officer, Mele Kyari and board chairman Pius Akinyelure.

President Bola Tinubu has sacked the board of the Nigerian National Petroleum Company (NNPC) including its Group Chief Executive Officer, Mele Kyari and board chairman Pius Akinyelure.

The decision, effective April 2, 2025, was announced in a statement by presidential spokesperson Bayo Onanuga.

President Tinubu cited the need for enhanced operational efficiency, restored investor confidence, and a more commercially viable NNPC as the driving forces behind the decision.

Invoking his powers under Section 59(2) of the Petroleum Industry Act (PIA) 2021, he reconstituted the board with new leadership aimed at repositioning NNPC Limited for greater productivity and alignment with global best practices.

Kyari was first appointed NNPC chief by former President Muhammadu Buhari but was reappointed in 2023 by President Tinubu.

As part of the overhaul, Bayo Ojulari takes over from Kyari as the new group CEO, while Ahmadu Musa Kida has been appointed as NNPC’s new non-executive chairman, replacing Pius Akinyelure. Also, Adedapo Segun has been confirmed as the company’s chief financial officer (CFO).

In line with the PIA, the president also appointed six non-executive directors from each geopolitical zone.

They include Bello Rabiu representing the north-west, Yusuf Usman from the north-east, and Babs Omotowa, a former managing director of the Nigerian Liquefied Natural Gas (NLNG), for the north-central.

Others are Austin Avuru for the south-south, David Ige for the south-west, and Henry Obih for the south-east.

Meanwhile, Lydia Shehu Jafiya, the permanent secretary of the federal ministry of finance, and Aminu Said Ahmed of the ministry of petroleum resources will represent their respective ministries on the new board.

“This restructuring is aimed at repositioning NNPC Limited for greater productivity and efficiency in line with global best practices. We are taking bold steps to transform the company into a more commercially driven and transparent entity,” the statement reads.

The changes take effect immediately, and the new board has been handed a strategic action plan, which includes a “review of NNPC-operated and Joint Venture Assets to ensure alignment with value maximisation objectives”.

news

Tinubu commended Nandap for her leadership, extends Comptroller-General tenure till 2026, says Onanuga

President Bola Tinubu has approved the extension of the tenure of the Comptroller-General of the Nigeria Immigration Service, Kemi Nandap, until December 31, 2026.

President Bola Tinubu has approved the extension of the tenure of the Comptroller-General of the Nigeria Immigration Service, Kemi Nandap, until December 31, 2026.

Nandap, who joined the NIS on October 9, 1989, was appointed as Comptroller-General on March 1, 2024, with an initial tenure set to end on August 31, 2025.

A statement by the president’s Special Adviser on Information and Strategy, Bayo Onanuga, on Monday, said for her leadership, noting improvements in border management, immigration modernisation, and national security under her watch.

“Under her leadership, the Nigeria Immigration Service has witnessed significant advancements in its core mandate, with notable improvements in border management, modernisation of immigration processes and national security measures.

“President Tinubu commended the Comptroller-General for her exemplary leadership and urged her to continue dedicating herself to the Service’s strategic priorities, which align with his administration’s Renewed Hope Agenda,” the statement read.

He also reaffirmed his commitment to supporting the NIS in safeguarding Nigeria’s borders and ensuring safe and legal migration.

news

Update : Fubara ordered bombing of Rivers Assembly, I am not under duress I resigned, Says ex-Rivers HoS Nwaeke

• Says suspended gov plotted Tinubu’s downfall through pipeline bombings

• ‘Fubara ordered Ehie to pull down Assembly to avert impeachment’

• Nwaeke links Bala Mohammed to sinister plot against President

• Says emergency saved Rivers, Nigeria from major disaster

The immediate past Rivers State Head of Service, Dr. George Nwaeke, yesterday gave what appears to be yet the most revealing insider’s account of some of the events that culminated in the March 18 suspension of Governor Siminilayi Fubara and the state Assembly for six months.

Nwaeke, who claimed to have been an eyewitness to some of the actions taken by Fubara, spoke of how the suspended governor allegedly plotted the destruction of the State House of Assembly and economic sabotage to ensure the downfall of President Bola Tinubu.

Nwaeke, in a video press conference and a statement, claimed that Fubara masterminded the bombing of the state House of Assembly, using his Chief of Staff, Edison Ehie.

Nwaeke was appointed as head of service by Fubara.

He said he was prompted to set the records straight following “the loads of misinformation on print and electronic media.”

He said he was not sacked neither or pressured to resign but resigned “willingly from the depth of my heart.”

He said: ”However, as an insider and a key player in this administration by my position, who worked closely with Siminilayi Fubara, it will be unfair for me to keep silent or not to address some key factors that has affected or will affect our state if we continue on this trajectory.”

He thanked the President for “a swift intervention in Rivers State crisis, especially on the state of emergency that was declared and assented to by the National Assembly.”

He added: “You will recall that when the governor was suspended, as the head of service, I was the next in command. So I am not speaking from outside, I am speaking as an insider.

“If not for the intervention of Mr. President, Nigeria would have faced the worst economic sabotage and Rivers State would have been up in flames.

“First, it all started with the Rivers State House of Assembly where the Governor, Siminilayi Fubara, directed his Chief of Staff (Edison Ehie) to burn down the assembly in a way to avert his impeachment.

“That evening, Edison was in Government House with two other boys, including the former Chairman of Obio/Akpor LGA, one Chijioke. I was there with them when a bag of money was handed over to Edison for that operation, though I do not know the amount inside.

“I want to tell Rivers people today that the House of Assembly complex in Moscow Road was clearly brought down by Edison Ehie under the instructions of Governor Siminilayi Fubara, I challenge him to an open confrontation and I will throw more light on it.

“A day after that incident, I almost resigned, but I was very scared because I know the power of a sitting governor and he knew that I am aware of the whole plan and that I am discomforted with the unconscionable act and deliberate posture of innocence and mien of a sheep.”

He also alleged that another attempt was made to “destroy the residential quarters of the House of Assembly members.”

Continuing, he said: “If not for the press conference that was held there by Rivers youths, Rivers elders and National Assembly members, that would have been another barbaric demolition in Rivers State.

“I came to realise that they actually wanted to demolish that second building, because after some weeks, he personally told me that if he knew early, he would have gone to pull down their hall before visiting the residential quarters of the assembly, and that he didn’t actually know that they had such a beautiful hall where they are using now for their sitting.

“I was shocked and I asked myself how could a man that wants to lead his people be destroying his state assets and wasting public funds on a needless ego fight.”

Nwaeke appealed to critics of the declaration of emergency rule by President Tinubu to retract their statements, saying without the urgent intervention, a lot of things would have gone wrong in the state.

Such critics, according to him, ”are only seeing the surface. If the President did not take proactive step, no one knows who would have been affected by the sinister plans that were cooking.”

He asked the President “not to give up on Rivers State affairs because a lot is going on there with Governor Fubara.”

He said one of the factors that “got me removed was when Governor Fubara told me that they would use the Ijaw to decide who would become the next president of Nigeria, and I asked him how will that work? Is it by votes or by what means?”

On alleged plan to shoot down the second term of President Tinubu, Nwaeke said: “He clearly told me that he is the chief security officer of Rivers State and his brother is in charge of Bayelsa State, and all the pipelines are under their care; that at the appropriate time, they would tell the boys what to do, and fund was not an issue.

“That was why when he made that statement in his public function that “I will tell the boys what to do at the appropriate time” I knew something was up and perhaps the time was near.

“He boasted to be the ‘David that will bring down the Goliath of Rivers State.’ That he has the backing of the cream-de-la cream in the state.

“The plan was to start from non-Ijaw speaking areas to destroy oil facilities to remove attention from the Ijaw and make it have a statewide look. The Ogoni, Oyibo, Ahoda areas were to be bombed first before the Ijaw zones. This would have brought down the government of President Tinubu and usher in a new President from the coalition of political parties with a Vice President from the Ijaw.

“The media was to be captured by paying heavily for airtime and retaining the social media influencers and known social critics on their payroll.

“I am not unaware of what this revelation means, but I am doing this to free my conscience and warn those innocent persons that are used to sway public sentiment that there is more than meets the eye in the Rivers matter.

“Sometimes I slept over in Government House. But I started being uncomfortable when Governor Bala Mohammed and some other stakeholders started nocturnal visits to Rivers State.

“I recall after one of such visits he told me that he would support Bala Mohammed or any other northerner for president; that discussions were ongoing.

“Although I was not bothered about whom he supports, I was more concerned about the quantum of state resources that he releases to these visitors at each visit.”

Nwaeke asked the Nigeria Labour Congress (NLC) to call their Rivers labour leaders to order to avoid politicising labour in the state.

He said he was privy to several private meetings between the governor and labour leaders in the state and the largesse that accompanied each meeting to compromise the Labour Union.

“More worrisome is several meetings between the governor, his chief of staff and some militant leaders. The details of which meetings I was not privy to since I was not allowed into the meetings.

“However, each meeting ended with huge sums of money paid to attendees.”

He said Rivers people and the generality of Nigerians are “the beneficiary of the declaration of state of emergency rule in Rivers State and not Governor Fubara or Minister Wike.”

He stressed the need for the state’s Sole Administrator, Vice Admiral Ibok-Ete Ibas (rtd), to “step up his guards and be very vigilant, because I am aware of the sinister arrangement and dastardly plans to continue to hatch their plans if not put in check.”

He said: “This accounts for the organised media condemnations and seeming public outcry against Mr. President and National Assembly.

“Those who love democracy and humanity will always protect humanity and democracy. Mr. President, you have just protected democracy and humanity in Rivers State. I can now sleep with my conscience clear.”

Wike slams NBA for ‘hypocrisy’ on state of emergency

Federal Capital Territory (FCT) Minister Nyesom Wike yesterday faulted the Nigeria Bar Association’s (NBA) stance that the declaration of state of emergency in Rivers by President Bola Tinubu was unconstitutional and illegal.

Wike alleged that the NBA discredited Tinubu’s decision because the Rivers Government had promised to host its annual general conference.

The minister stated this when officials of the Body of Benchers, led by its Chairman, Chief Adegboyega Awomolo (SAN), visited him in Abuja.

He added that the association did not support the declaration of the state of emergency because there would be no money to give to the NBA for the conference.

“What kind of hypocrisy is this?” he queried.

The minister called on the Body of Benchers to call the NBA to order over the association’s unnecessary criticism of the judiciary.

He said that the body should not sit and watch, while the NBA and its members destroy the legal profession.

He said that some of the members of NBA, often without reading a judgement, go on national television to condemn the judgment and criticise the judges.

He said that such actions have continued with no sanction.

“If you don’t discipline somebody, nobody will learn any lesson.

“We shall no longer allow our profession to be pulled down. I cannot believe, as a lawyer, that you make a contribution to help the legal profession, and you will be criticised by your fellow lawyers.

“Sir, time has come that we need to say look, enough is enough. We cannot continue to discourage our judges and justices. It is not done anywhere.

“I have never seen where members of a profession are the ones that are bent on bringing the profession down,” he said.

The minister also accused the NBA of describing any support rendered by the executive arm of government to the judicial arm as a bribe.

Wike recalled that when NBA was building its National Secretariat, the leadership wrote to the executive for support, adding that nobody saw that as a bribe.

“I was the only one who contributed to the NBA to build the National Secretariat. The NBA didn’t see it as a bribe.

“When you contribute to the Body of Benchers, it is a bribe, but when you contribute to NBA, it is not a bribe, they will take it.

“The same NBA will rely on state governments to sponsor their activities, but when the state government supports the judiciary it is bribery,” he added.

Wike said that the constant taunting of judges and justices had made them to avoid attending social gatherings or going to church or mosque for fear of molestation.

He added that judges could no longer shake people’s hands freely because lawyers would accuse them of collecting bribes.

“It has gotten to the stage that our Judges are so scared of going to a mosque or church or even greeting somebody they know because of fear of bribery.

“They run away from shaking people’s hands because they will start accusing them of collecting bride. This must stop,” he said

The immediate past Rivers Head of Service, George Nwaeke, has denied claims by his wife, Florence, that he was kidnapped and under duress.

Nwaeke, who recently released chilling allegations against suspended Governor Siminalayi, said contrary to his wife’s emotional outbursts, he was safe in Abuja.

He disclosed that he went to Abuja to voluntarily report himself to security agencies over the ongoing crisis in Rivers State.

The former HoS spoke in a trending video released early hours of Saturday.

He insisted thatwife’s claim was false and suggested that she had been misled and given a script to read.

He said: “I am in Transcorp Abuja. I arrived this morning from Port Harcourt to meet security agencies and report myself, as well as the troubling events happening in Rivers State. I resigned as Head of Service on Monday because of these developments”.

Addressing his wife, he said: “I just saw a video of my wife trending. She was told I had been kidnapped and given a script to read. I want to make it clear—I am not kidnapped. I am in Abuja, working.

“When I was Head of Service, my wife was not involved in my official duties. That script she read is null and void. I am safe and sound. I will report myself to the appropriate security agencies because Abuja houses their headquarters, and I feel safer making my report here.”

-

news4 years ago

news4 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

news1 year ago

news1 year agoEnvironmental Pollutions : OGONI COMMUNITY CRIES OUT, THREATENS TO SHUT DOWN FIRSTBANK,SHELL OIL COMPANY OPERATIONS FOR NOT PAYING COURT AWARD

-

news6 days ago

news6 days agoUpdate : Fubara ordered bombing of Rivers Assembly, I am not under duress I resigned, Says ex-Rivers HoS Nwaeke

-

news2 days ago

news2 days agoBreaking : TInubu appoints Bashir Ojulari as new CEO group of NNPC and GMD mele kyari get sacked, Says Onanuga

-

interview3 days ago

interview3 days agoNIGERIA MECHANIZED AGRO EXTENSION SERVICE PROJECT, A STRATEGIC MOVE TO ALLEVIATE POVERTY – DR. AMINU ABDULKADIR

-

brand6 days ago

brand6 days agoGTCO Plc Releases 2024 Full Year Audited Results …Pays Shareholders Record Dividend of N8.03k for 2024 Financial Year

-

news3 days ago

news3 days agoTinubu commended Nandap for her leadership, extends Comptroller-General tenure till 2026, says Onanuga

-

brand1 week ago

brand1 week agoZENITHz BANK MAINTAINS SUPERLATIVE PERFORMANCE WITH PBT OF N1.3 TRILLION IN FULL YEAR 2024