Uncategorized

Alleged N10b scandal rocks NIPOST’s As Senate Orders Probe of Illegal Shares Transfer

Senate orders deregistration of subsidiaries, probe of shares transfer

BPE defends shares acquired in officials’ names

The Senate has ordered a probe into the N10 billion restructuring funds released to NIPOST by the Federal Ministry of Finance.

This followed the discovery of irregularities in the agency’s subsidiaries – NIPOST Properties and Development Company and NIPOST Transport and Logistics Services Limited.

In its resolution of December 30, 2023, Red Chamber said it uncovered alleged illegal transfer of federal government shares in two NIPOST subsidiaries to private individuals.

The discovered infractions sparked outrage, prompting the lawmakers to call for immediate action.

Newsthumb investigation shows that some individuals in key positions within the Bureau of Public Enterprises (BPE) and NIPOST were listed as shareholders of the two NIPOST subsidiaries.

The Corporate Affairs Commission (CAC) records confirm that as of November 8, 2023, some top officials of BPE control significant shares in the subsidiaries.

Responding to these discoveries, the Senate passed a resolution on December 30, last year.

The resolution declared the NIPOST subsidiaries in question “irregular and illegal” and recommended their immediate winding-up and deregistration.

The Senate resolution goes beyond immediate action, it demanded a thorough investigation into the N10 billion voted by the Ministry of Finance for NIPOST’s restructuring and recapitalisation.

Should evidence of “injudicious utilisation” surfaces, the Senate said the committee responsible must recover the full amount.

The resolution reads: “The sum of N10 billion released by the Ministry of Finance for the proposed NIPOST restructuring and recapitalisation be investigated and the funds fully recovered if established to be injudiciously utilised by the relevant committee of the Assembly charged with the responsibility of fiscal prudence.”

A high-ranking government official, who spoke on the condition of anonymity, painted a picture of the potential consequences of the alleged malfeasance.

The official highlighted the immense value of NIPOST’s property assets, estimated in trillions of naira and expressed the alarm at the prospect of the assets falling into private hands through share inheritance.

“Imagine 15 years from now when none of us is on the scene, their children can come and lay claims to the shares and in the eyes of the law, those shares will belong to whoever their next of kin will be, for government assets,” the official told our correspondent.

He further emphasised: “The alleged share transfers represent a blatant disregard for established legal frameworks. Even the recently enacted Petroleum Industry Act (PIA) allocates shares to corporate entities, not individuals.”

It was learnt that after receiving a letter on the infraction, the individuals involved hurriedly reassigned their shares in NIPOST Transport and Logistics to three government entities: NIPOST (80%); BPE (10%) and the Ministry of Finance Incorporated (MOFI) (10%).

Our correspondentalso discovered controversial shareholding arrangements that have led to changes in the ownership structure of NIPOST Properties and Development Company.

As the official noted, “BPE has no business holding shares in NIPOST, and the involvement of an MDA in shareholding directly contradicts established procedures.”

The government official who raised doubts over the credibility of the transaction stated that “the Senate is unwavering in its stance, demanding investigation and rectification”.

“The NIPOST scandal raised serious questions about corporate governance and asset protection within public institutions. The Senate’s swift action and call for investigations are commendable, but ensuring swift, comprehensive, and transparent results is paramount. The Nigerian public deserves clear answers and the assurance that their national assets are being protected with utmost integrity,” the official said.

Reacting to enquiries from our correspondent, a BPE official said: “The NIPOST subsidiaries were registered in 2020 and at the time, the CAC portal only allowed individuals to be shareholders as there was no option of using companies as shareholders.

“This was because the commission wanted to hold people accountable in respect of shares ownership. Subsequently the CAMA 2020 became operative in January 2021, which was six (6) months after the Companies were registered.

“The portal was thereafter updated to allow companies to hold shares but with representatives. The shareholding of NIPOST subsidiaries has been duly corrected to reflect the intent of the subscribers.”

politics

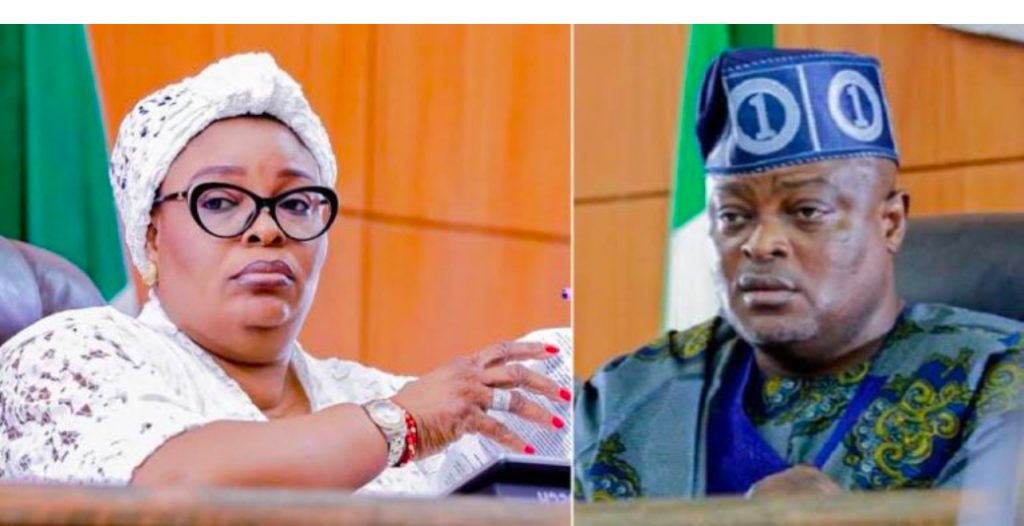

Update : Lagos Crisis: Details on how DSS interfered in legislative affairs in LSHA, says Hon. Ogundipe.

Our attention has been drawn to a publication by the Department of State Security (DSS) regarding a letter dated 14th February 2025,

Our attention has been drawn to a publication by the Department of State Security (DSS) regarding a letter dated 14th February 2025,

“Enhanced Security Measures for LSHA,”

Earlier today, lawmakers and staff of the Lagos State House of Assembly arrived at the Assembly complex to find the offices of the Speaker, the Deputy Speaker, and the Acting Clerk of the House locked and access restricted by operatives of the DSS. Furthermore, the legislative chamber itself was sealed off.

In an apparent effort to justify their actions, the DSS released to the public a letter written by the Acting Clerk of the House, requesting security presence at the Assembly complex.

We wish to categorically state that this is not the first time the House has sought security support from the DSS.

However, it is important to emphasize that in all previous instances, DSS operatives have been stationed at the main gate of the Assembly complex, ensuring that unauthorized persons do not gain entry.

For the avoidance of doubt, at no point did the letter requesting security assistance instruct the DSS to:

– Invade the legislative chamber

– Lock and restrict access to the Speaker’s office

– Lock the office of the Acting Clerk

– Lock the Deputy Speaker’s office

The events of today raise serious concerns about undue interference in legislative affairs. The sanctity of the Lagos State House of Assembly was undermined by armed DSS operatives who actively obstructed lawmakers from performing their constitutional duties.

This act amounts to an infringement on the independence of the legislature and a direct assault on democratic governance.

We reiterate that the lawmakers of the Lagos State House of Assembly have taken a decisive and lawful step in the removal of the former Speaker, Mudashiru Ajayi Obasa. We stand firmly behind the leadership of the Rt. Hon. Speaker, Mojisola Lasbat Meranda, and remain resolute in our commitment to enacting laws that foster the development and progress of Lagos State.

We call on all relevant authorities to investigate this unwarranted restriction on legislative activities and ensure that such incidents do not recur.

*E-signed*

Hon. (Otunba) Ogundipe Stephen Olukayode

*Chairman, House Committee on Information, Strategy, and Security*

Uncategorized

Access Bank Lagos City Marathon 2025: A Tribute to Legacy, A Celebration of Resilience

Lagos gears up for the highly anticipated Access Bank Lagos City Marathon on Saturday, February 15, 2025, excitement and emotion run high. This year’s edition is much more than a race, it is a moving tribute to legacy and a celebration of resilience. Under the evocative theme “Miles to Memories,” every stride taken by the runners transforms physical distance into lasting recollections, blending athletic endurance with heartfelt remembrance of a visionary leader.A Race that Transcends the Finish LineSince its inaugural run in 2016, the Access Bank Lagos City Marathon has evolved from a local initiative into a global phenomenon. Originally established by Access Bank in collaboration with the Lagos State Government to promote healthier lifestyles, the event has grown into a symbol of unity, progress, and economic vitality for both Lagos and Nigeria. Today, the marathon not only places Lagos on the global sporting map but also showcases how major sporting events can drive tourism and stimulate business growth. As a Gold Label Marathon certified by the Association of International Marathons and Distance Races (AIMS), it stands as a testament to the powerful synergy between sport, community, and commerce.Local businesses, from hotels and restaurants to vendors and transport providers, thrive during the marathon weekend, benefiting from increased patronage as communities come together to support and celebrate the event. This collective participation reinforces the idea that when people unite around a common purpose, the rewards are shared by all.Honoring a Visionary: Remembering Herbert WigweThis year, the marathon carries added emotional significance. It marks the first anniversary of the passing of Herbert Wigwe, the late Group Chief Executive Officer of Access Holdings PLC, who was a transformative force behind the event. On the morning of February 10, 2024, a tragic helicopter crash claimed the lives of Herbert Wigwe, his wife, his son, and Abimbola Ogunbanjo, the former Group Chairman of the Nigerian Exchange Group PLC. The loss sent shockwaves throughout the nation, leaving an indelible void in the hearts of many Nigerians.Despite the deep sense of loss, Herbert Wigwe’s legacy continues to inspire. In the wake of the tragedy, concerns arose that Access Bank might reconsider its sponsorship of the marathon. Instead, in a poignant gesture of remembrance and commitment, Access Bank, together with the Lagos State Government, has reaffirmed its support for the marathon. This enduring dedication ensures that Wigwe’s dreams and aspirations remain an integral part of every step taken by the runners.

Lagos gears up for the highly anticipated Access Bank Lagos City Marathon on Saturday, February 15, 2025, excitement and emotion run high. This year’s edition is much more than a race, it is a moving tribute to legacy and a celebration of resilience. Under the evocative theme “Miles to Memories,” every stride taken by the runners transforms physical distance into lasting recollections, blending athletic endurance with heartfelt remembrance of a visionary leader.A Race that Transcends the Finish LineSince its inaugural run in 2016, the Access Bank Lagos City Marathon has evolved from a local initiative into a global phenomenon. Originally established by Access Bank in collaboration with the Lagos State Government to promote healthier lifestyles, the event has grown into a symbol of unity, progress, and economic vitality for both Lagos and Nigeria. Today, the marathon not only places Lagos on the global sporting map but also showcases how major sporting events can drive tourism and stimulate business growth. As a Gold Label Marathon certified by the Association of International Marathons and Distance Races (AIMS), it stands as a testament to the powerful synergy between sport, community, and commerce.Local businesses, from hotels and restaurants to vendors and transport providers, thrive during the marathon weekend, benefiting from increased patronage as communities come together to support and celebrate the event. This collective participation reinforces the idea that when people unite around a common purpose, the rewards are shared by all.Honoring a Visionary: Remembering Herbert WigweThis year, the marathon carries added emotional significance. It marks the first anniversary of the passing of Herbert Wigwe, the late Group Chief Executive Officer of Access Holdings PLC, who was a transformative force behind the event. On the morning of February 10, 2024, a tragic helicopter crash claimed the lives of Herbert Wigwe, his wife, his son, and Abimbola Ogunbanjo, the former Group Chairman of the Nigerian Exchange Group PLC. The loss sent shockwaves throughout the nation, leaving an indelible void in the hearts of many Nigerians.Despite the deep sense of loss, Herbert Wigwe’s legacy continues to inspire. In the wake of the tragedy, concerns arose that Access Bank might reconsider its sponsorship of the marathon. Instead, in a poignant gesture of remembrance and commitment, Access Bank, together with the Lagos State Government, has reaffirmed its support for the marathon. This enduring dedication ensures that Wigwe’s dreams and aspirations remain an integral part of every step taken by the runners.

www.accessbankplc.com

“Miles to Memories”: A Journey of Emotion and EnduranceThe theme “Miles to Memories” perfectly encapsulates the spirit of this year’s marathon. It suggests that every mile covered is imbued with personal and collective memories, reminders of challenges overcome, of unity celebrated, and of hope nurtured for a better future. For many participants, the race is a chance to commemorate Herbert Wigwe, whose visionary leadership not only transformed Access Bank but also reshaped the sporting landscape of Lagos. His enduring commitment to community development, healthy living, and economic empowerment continues to serve as a beacon for all who aspire to make a positive impact.Each runner’s journey on the race day acts as a bridge between past and future, where the physical act of running becomes a metaphor for overcoming adversity and building a hopeful tomorrow. The event stands as a tribute not only to athletic excellence but also to the unyielding human spirit that continues to rise in the face of loss.From Humble Beginnings to Global ProminenceWhen Access Bank and the Lagos State Government first partnered in 2016 to host the marathon, their goal was simple: to encourage a healthier lifestyle among Lagosians. Under Herbert Wigwe’s visionary leadership, the event quickly grew in stature. Today, it has attracted over 600,000 registered athletes from 14 countries, establishing itself as one of Africa’s most prestigious road races. This remarkable evolution is a testament to the power of visionary leadership, community engagement, and a relentless pursuit of excellence.The marathon’s growth from a local initiative to a globally recognised event highlights how passion and determination can transform a modest idea into an internationally celebrated movement. Lagos has firmly established itself as a marathon city renowned for its energy, hospitality, and unwavering commitment to progress.Herbert Wigwe’s Vision: A Marathon for Unity & ProgressHerbert Wigwe’s influence on the Access Bank Lagos City Marathon remains as palpable today as ever. During the 2021 edition, he stated:“As one of the leading banks in Nigeria and indeed Africa, it is imperative for us to support the economic and social development of the communities in which we operate. Hence, we have sponsored the Access Bank Lagos City Marathon to make Lagos more attractive to tourists and investors alike. We have also used this platform to create jobs and opportunities for thousands in the state.”These words, imbued with hope and ambition, continue to guide the event. More than merely a race, the marathon has become a living legacy of Wigwe’s unwavering

www.accessbankplc.com commitment to community development and the transformative power of sport. His visionary approach has paved the way for countless initiatives that enrich lives, create employment opportunities, and foster pride and unity among Nigerians.Herbert Wigwe’s legacy is not confined to history, it lives on in the hearts of those he touched and in the strides of every runner who participates in the marathon. His vision for a healthier, more prosperous Lagos inspires all, ensuring that his contributions will never be forgotten. Every cheer from the crowd, every drop of sweat on the pavement, and every moment of reflection during the race stands as a tribute to a man dedicated to progress, unity, and excellence.The Access Bank Lagos City Marathon 2025 is more than a sporting event—it is a movement that transforms challenges into triumphs and distances into memories. It celebrates life, resilience, and the indomitable spirit of a community marching forward, one determined step at a time.Sponsors: The Pillars Behind the MarathonCentral to the success of the Access Bank Lagos City Marathon are its dedicated sponsors. Access Bank, the major sponsor, has remained steadfast in its commitment to community development, ensuring that the marathon continues to be a platform for positive change. In partnership with the Lagos State Government, the event has grown into a major contributor to the local economy and an enduring source of inspiration for athletes and citizens alike.Their unwavering support has been crucial in maintaining the high standards of the marathon, including its prestigious Gold Label status from AIMS. This commitment not only honours Herbert Wigwe’s legacy but also ensures that the marathon continues to inspire future generations to embrace a healthy, active lifestyle while cherishing the memories forged along the way.Community, Commerce, and the Spirit of ResilienceThe Access Bank Lagos City Marathon is a celebration of more than athletic prowess, it is a testament to the power of community and the resilience of Lagosians. The event has consistently demonstrated that when communities unite, remarkable achievements are possible. By boosting local tourism and generating business opportunities, the marathon has had a transformative impact on the city’s economy.During marathon weekend, local businesses such as hotels, restaurants, and retail outlets experience a surge in activity as visitors from around the globe flock to Lagos. At the same time, the event showcases the city’s vibrant culture on an international stage, reinforcing the idea that sport and commerce can work hand in hand to drive progress.

www.accessbankplc.com The Journey Ahead: Legacy, Resilience, and UnityAs runners prepare to take to the streets of Lagos on February 15, 2025, the atmosphere is charged with a profound sense of purpose. The marathon is not just a competition; it is a journey of remembrance and unity, where every stride honors the memory of Herbert Wigwe and every mile becomes a cherished memory. The theme “Miles to Memories” reminds participants that the race is as much about personal triumph as it is about collective resilience and hope.In the face of past tragedies and challenges, the marathon stands as a beacon of hope. It is a day when the nation comes together to celebrate life, honor legacy, and build a future founded on unity and progress. Each runner carries with them the spirit of determination and the memory of a leader who believed in the power of community and the strength of collective ambition.In celebrating “Miles to Memories,” the Access Bank Lagos City Marathon 2025 encapsulates the journey from loss to legacy, from grief to hope, and from memories to future milestones. With the steadfast support of sponsors like Access Bank and the Lagos State Government, this marathon not only delivers an exhilarating athletic challenge but also forges enduring memories that will inspire generations to come.As the starting gun fires and runners take their first steps on the vibrant streets of Lagos, they are not merely participating in

news

BREAKING: Supreme Court dismisses Fubara’s appeal against Amaewhule-led Assembl, Ordering the Representation of 2024 Budget

A five-man panel of the Supreme Court, led by Justice Uwani Abba-Aji, has dismissed an appeal filed by Rivers Governor, Siminalayi Fubara, challenging the leadership of the Rivers House of Assembly under Speaker Martin Amaewhule.

A five-man panel of the Supreme Court, led by Justice Uwani Abba-Aji, has dismissed an appeal filed by Rivers Governor, Siminalayi Fubara, challenging the leadership of the Rivers House of Assembly under Speaker Martin Amaewhule.

Delivering the ruling, Justice Abba-Aji imposed a cost of ₦2 million against Governor Fubara, payable to the Rivers Assembly as the first respondent and Speaker Martin Amaewhule as the second respondent.

The court’s decision to dismiss the appeal followed the withdrawal of the suit by Fubara’s legal counsel, Yusuf Ali.

With this ruling, the leadership structure of the Rivers Assembly under Amaewhule remains intact.

-

news4 years ago

news4 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

news6 days ago

news6 days agoUpdate : Fubara ordered bombing of Rivers Assembly, I am not under duress I resigned, Says ex-Rivers HoS Nwaeke

-

news1 year ago

news1 year agoEnvironmental Pollutions : OGONI COMMUNITY CRIES OUT, THREATENS TO SHUT DOWN FIRSTBANK,SHELL OIL COMPANY OPERATIONS FOR NOT PAYING COURT AWARD

-

news2 days ago

news2 days agoBreaking : TInubu appoints Bashir Ojulari as new CEO group of NNPC and GMD mele kyari get sacked, Says Onanuga

-

interview3 days ago

interview3 days agoNIGERIA MECHANIZED AGRO EXTENSION SERVICE PROJECT, A STRATEGIC MOVE TO ALLEVIATE POVERTY – DR. AMINU ABDULKADIR

-

news4 days ago

news4 days agoTinubu commended Nandap for her leadership, extends Comptroller-General tenure till 2026, says Onanuga

-

brand7 days ago

brand7 days agoGTCO Plc Releases 2024 Full Year Audited Results …Pays Shareholders Record Dividend of N8.03k for 2024 Financial Year

-

brand1 week ago

brand1 week agoZENITHz BANK MAINTAINS SUPERLATIVE PERFORMANCE WITH PBT OF N1.3 TRILLION IN FULL YEAR 2024