In a clear demonstration of its industry leadership and consistency in providing superior financial returns, Zenith Bank Plc has announced its audited results for the half-year...

The Zambian Minister of Commerce and Industry, Mr. Chipoka Mulenga, has sought the assistance of the President, Dangote Group, Aliko Dangote in the development of his...

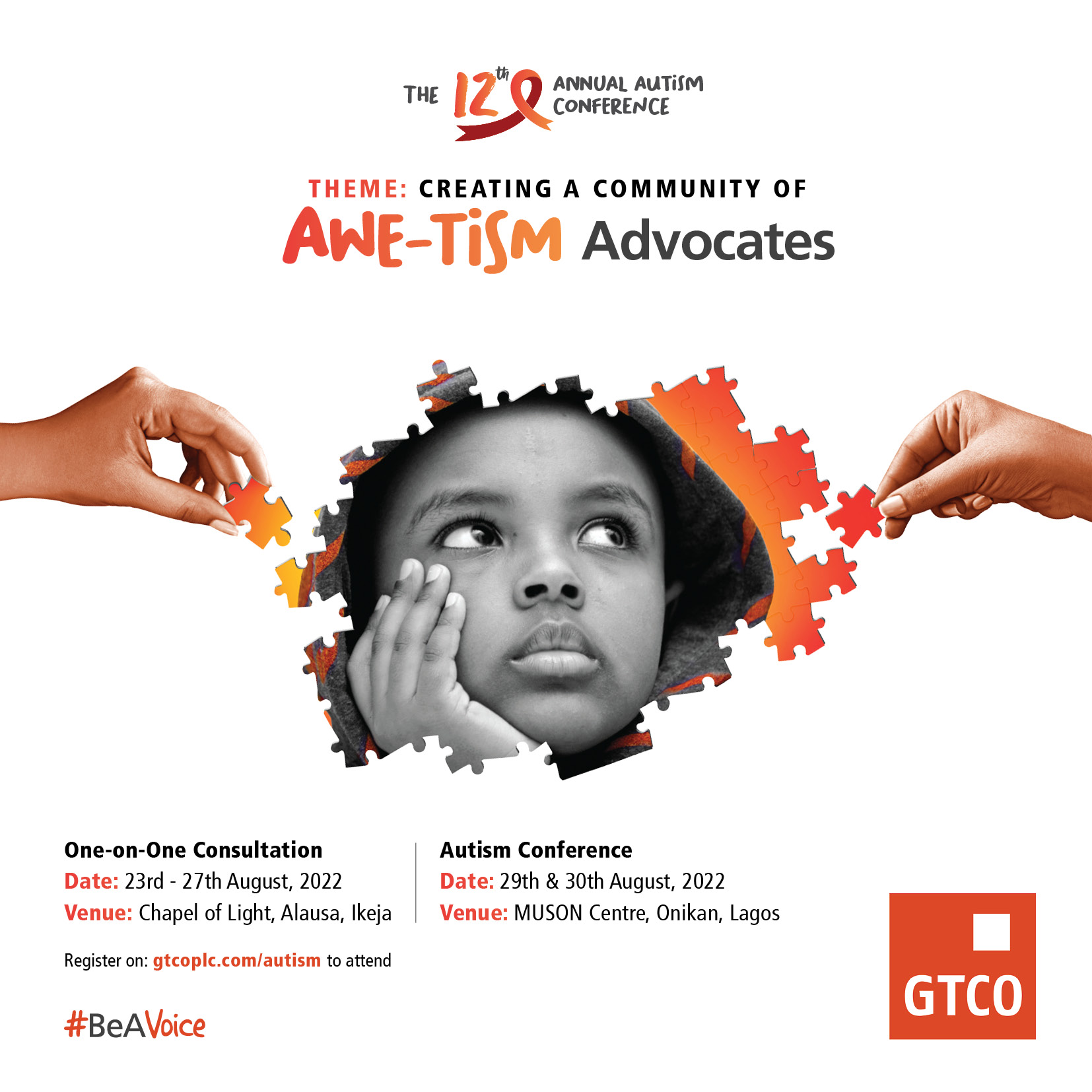

The 12th edition of the annual GTCO Autism Conference themed “Creating a Community of Awe-Tism Advocates” will hold on Monday and Tuesday, August 29th and 30th,...

Stanbic IBTC Pension Managers, a subsidiary of Stanbic IBTC Holdings, recently launched a robust marketing campaign to further drive awareness of the Pension scheme as well...

Consumers of SuperBite Premium Sausage Roll and Beefie Beef Roll are in for a more satisfying experience as their favourite brands now come in new, bigger...

First Bank of Nigeria Limited has announced its commemoration of the 2022 International Youth Day, globally celebrated today, 12 August 2022 and themed “Intergenerational solidarity: Creating...

Our attention has been drawn to an online report on the purported sale of Polaris Bank Limited. This publication is speculative, deliberately intended to create panic...

The Bank’s Firstmonie Agents play a critical role in promoting financial inclusion in the country The Bank currently has over 180,000 Firstmonie Agents spread across...

NoWema Bank Plc, pioneer of Africa’s first fully digital bank and one of Nigeria’s most resilient banks, has posted a growth performance across all financial indices...

L-R: New Executive Director, North Bank, Ms Emem Usoro; Group Chairman, Mr. Tony Elumelu; New Group Managing Director/CEO, Mr. Oliver Alawuba; and New Deputy Managing Director,...