opinion

I am in possession of the following helpful clarifications & factual rebuttals on the Titan/ Union Bank issue

This manner of intervention by Government either directly or through AMCON is not peculiar to Union Bank. All such “intervened banks” as they were called were insolvent with huge negative shareholders’ funds. The premise of the CBN-led intervention was that government needed to inject sufficient equity to bring networth to zero to make investment a reasonable contemplation by private shareholders. Put simply, no private shareholder will invest in a bank with negative shareholders’ funds in hundreds of billions when a fresh licence remained at a price tag of N25bn. And with a few hundred billions, such investors could acquire profitable stakes in some of the listed banks. Bear in mind that at that point, the market capitalisation of the best banks such as GT, Zenith, Access were less than N1 trillion. So N100bn could get a 10% stake in any of these banks, maybe more.

This manner of intervention by Government either directly or through AMCON is not peculiar to Union Bank. All such “intervened banks” as they were called were insolvent with huge negative shareholders’ funds. The premise of the CBN-led intervention was that government needed to inject sufficient equity to bring networth to zero to make investment a reasonable contemplation by private shareholders. Put simply, no private shareholder will invest in a bank with negative shareholders’ funds in hundreds of billions when a fresh licence remained at a price tag of N25bn. And with a few hundred billions, such investors could acquire profitable stakes in some of the listed banks. Bear in mind that at that point, the market capitalisation of the best banks such as GT, Zenith, Access were less than N1 trillion. So N100bn could get a 10% stake in any of these banks, maybe more.

Should CBN have bailed out these banks at such a high price? Might it not have been cheaper to pay off retail depositors and liquidate the banks? Possibly. But that is a debate for another day. The point is that whether it was Union, or Afribank, or Keystone (I forget the other two as there were 5 such banks), CBN through AMCON invested significant princely sums to bring equity to zero to get the brides ready for suitors.

My recollection is also that Tunde Lemo’s exit from CBN is over 7 years, maybe more. How long should a cooling off period be? I guess we need to make a call here on when the cooling off is sufficient lest it becomes a freeze to death. I am not in a position to confirm if the Union Bank acquisition was a major object when Titan was floated. Mr. Lemo and his colleagues would have to speak to that. My guess is probably not.

Disclosure: Tunde was my classmate in UNN Accountancy class of 1980-84, the only First Class in the group. So far, his ethical commitments through his career starting from Arthur Andersen through some banking institutions including Wema where he was CEO to CBN as Deputy Governor have been sterling.

[28/12, 18:53] : Since early 2011 , banks were advised to sell their non banking subsidiaries by CBN.

UBA Sold UBA capital now United Capital and changed UBA properties to Afriland among others.

Zenith sold the registrars and others subsidiaries while Access Bank sold Access Mortgages and others.

GTBank sold GT Assurance and GTHomes.

Yes, FBN / CBN can inject funds to stabilize any bank.

That does not mean that they must sell or divest at a premium.

Keystone was sold far less than the amount injected by CBN/FGN. The buyers got a lot of waivers.

Same applies to Polaris Bank.

They cant even sell at half the amount they injected into Polaris Bank.

They injected funds and bought toxic loans from top defaulters and others .

Union Banks non banking subsidiaries were sold.

Union Homes , a major subsidiary was bought by Aso Savings.

Yet , Aso Savings is at almost at the same level with Union Homes presently.

What Titan / TGI Group bought was in the market for market for more than eight years.

They were practically “hawking the bank ”

Access Bank made two attempts long before Diamond Bank merger.

Zenith Bank almost got it at the same time Access merged with Diamond Bank.

Truth is , not many banks were keen on acquiring Union Bank .

The Private Equity holding of Africa Capital Alliance and their consortium plus Atlas Mara gladly sold to a willing and capable buyer approved by CBN.

Access Bank bought some banks via Atlas Maras Investment outside of Nigeria.

It was natural for Access to buy Union Bank in Nigeria but something happened and CBN stopped it.

As the regulator and monitor, CBN have absolute right to waive a lot of things and approve such transactions.

These are big ticket transactions that does not meet all the checklist !

However , Union Bank is on transit.

The new owners may sell after 60 months to a new buyer.

What they have done is to move the bank away from core investors and CBN.

Any of the top five banks may even buy or merge with Union Bank later in less than 60 months time.

opinion

Challenges Arising : Tinubu focussed on turning the economy round for growth, development and prosperity, Says Onanuga

Nigerians should expect better days in 2024 when some of the decisions taken by the Bola Tinubu Administration will have started yielding positive dividends,the President’s Special Adviser on Information and Strategy, Mr. Bayo Onanuga, said yesterday.

Nigerians should expect better days in 2024 when some of the decisions taken by the Bola Tinubu Administration will have started yielding positive dividends,the President’s Special Adviser on Information and Strategy, Mr. Bayo Onanuga, said yesterday.

Tinubu,according to him,is focussed on turning the economy round for growth, development and prosperity.

Onanuga, in a statement entitled “The many silver linings of Tinubu’s 7 months in office” said: “we expect the silver linings, that are at present understated, to blossom into rays of sunshine to be experienced by all Nigerians.”

The statement: “The removal of fuel subsidy and the move to merge foreign exchange rates, two headline reforms introduced by the Tinubu administration since late May, triggered problems such as high fuel prices and the depreciation of the Naira, two monstrosities which combined to cause a general spike in costs of services and goods.

“Today, many Nigerians complain of a rise in the cost of living.

“According to the latest NBS report, Nigeria’s inflation, which rose to 26.7 percent in September, again rose to 28.2% in November from 27.33% in October. Food Inflation remains untamed, rising from 31.52% in October to 32.84% in November 2023.

“To compound the economic problems, few multinational companies such as GlaxoSmithKline, Procter & Gamble have announced their exit from our country, complaining about the difficult operating environment and the scarcity of dollar.

“The truth is that the new policies alone are not solely responsible for the economic problems we are facing today. We were destined for the tough and rough patch, where we are today because of the prevailing conditions before Tinubu took over on 29 May.

“As at June 2023, budget deficit was N10.8 trillion. Actual Debt service was 98.95 percent of revenue, far higher than the projected 59.37 percent. Inflow into the country’s foreign reserve came in trickles. And so bad was the state of affairs that Nigeria could not remit about $800 million fund of foreign airlines. JP Morgan exposed our near insolvency by claiming in a report that our net foreign reserve was just about $3.7 billion, not the $33 billion plus flaunted by Emefiele’s CBN.

“President Tinubu, who promised during the campaign to take hard and difficult decisions, moved to tackle the economic problems from Day One, by first dispensing with the wasteful fuel subsidy that was billed to consume about N7trillion this year, five times more than what was provisioned for capital spending.

“President Tinubu is quite aware of the side effects of his move to reset our economy. Though his administration has earned plaudits from the World Bank, the IMF and rating agencies such as Moody’s and Fitch, he is not carried away by the praises.

“The moves are yielding some good effects. Amidst what some sections of the media perceive as general gloom, some silver linings are emerging, signposting that with a little more patience, our material conditions will improve and inflation will be tamed. For businesses, operating conditions will also improve.

“In its third quarter report for the year, the NBS reported that GDP grew by 2.54percent. In a similar period in 2022, GDP recorded a growth of 2.25%. To demonstrate that the sun may be shining on us again, the 2.54% GDP growth recorded in Q3, was also higher than the 2.51% recorded in Q2.

“The service sector, made up of information and communication, financial and insurance, was responsible for the growth witnessed in Q3. It had a 3.99% growth, contributing 52.7% of the aggregate GDP. The agriculture sector declined from 1.34% growth in Q2 to 1.3percent in Q3.

“Growth was also recorded in construction and real estate, metal ores(69.76%), coal mining(58.03%), chemical and pharmaceutical products(6.77%), Cement(4.2%) and construction(3.89%). Oil reported a negative growth of 0.85%, a major improvement to the negative 22.67% recorded at the same period last year. It was -13.43 in Q2 of 2022. The improvement in the oil sector and its contribution to GDP has been attributed to the improvement in the security of oil infrastructure and operations, leading to increased production. Going forward in this Q4 and 2024, the NNPC Limited is confident that the sector will continue to climb the curve.

“In the same Q3, according to NBS, the Industrial sector grew by 0.46%, an uptick compared with Q3 2022, when it had a negative 8% growth, even in the era of P&G and GSK exit.

“An interesting revelation in the NBS Q3 report was the big jump in the volume of trade, from N12.16 trillion in Q2 to N18.8 trillion. Trade volume in the same period in 2022 was N12.28 trillion. We also recorded a trade surplus of N1.89trillion in Q3, an increase from the N708.8 billion in Q2 2023. In Q3 in 2022, we recorded trade deficit of N409.39 billion.

“Value of exports in the third quarter was N10.35 trillion, far higher by 60.78 percent than the N6.44 trillion posted in Q2 2023. Crude oil dominated the export, accounting for 82.5 percent, a confirmation that our country is pumping out more oil for export unlike the previous years.

“Just as our exports increased, imports also increased, rising from N5.73 trillion in Q2 2023 to N8.46 trillion in Q3, a rise of 60.8 percent. The imports recorded in the quarter was also higher in value compared to Q3 2022, which was N6.34 trillion.

“As the Minister of Budget and National Planning, Atiku Bagudu noted in a recent report, economic prosperity in our country will be achieved with the reforms being implemented, supported by strong monetary and fiscal policies, food supply management and other intervention programmes.

“President Tinubu who has never shied away from acknowledging the temporary pains triggered by the reforms, gave an assurance in a recent newspaper interview that his Administration will continue to take proactive measures to wrestle with the problems. Many of these measures are already being taken and in the New Year, we expect the silver linings, that are at present understated, to blossom into rays of sunshine to be experienced by all Nigerians.”

opinion

Amanze Obi’s spiral of lies, Says Bayo Onanuga

and

and

On Monday 11 December, I stumbled on the 6th, in the series of opinions about the last general election being peddled by Daily Sun columnist, Amanze Obi. I was shocked by the cocktail of lies and fallacies put forward by the writer, on why his candidate, Peter Obi lost the last presidential election and President Bola Ahmed Tinubu won. This spurred my frantic search for the 5th edition. It was more of the same, indeed dangerous as Amanze tried, albeit fruitlessly, to instigate Christians and their leaders against President Tinubu and Vice President Kashim Shettima. Believing so much in his concocted Islamic conspiracy against Christians, Amanze Obi wondered why there was no “fury”, or ‘outrage’ displayed by the Christians after Tinubu’s election.

In the two articles that I read, Amanze, disappointedly, packed too many falsehoods about the last election such that ignoring him will be a great disservice to our people, especially the younger, impressionable, easily excitable ones. To Amanze and his ilk, I will say it is too early to start distorting the story of the last election, with clearly revisionist misleading information, that one will only come across at beer parlours or market places.

In trying to decode Tinubu’s emergence as candidate of the APC, Amanze Obi invented a conspiracy of northern muslims who had “the temerity to insist on a muslim-muslim ticket as a condition for power shift to the south”. There was nothing of such. Tinubu went into the primary election to slug it out with Rotimi Amaechi, Yemi Osinbajo, both Christians and Ahmad Lawan, a muslim. Religion was not the issue at this stage. What was at stake was each candidate’s appeal to party delegates. Tinubu won a landslide victory, because many delegates believed he has the experience, political and national network to beat other candidates from the other parties and succeed President Muhammadu Buhari. Tinubu, as candidate, saw himself as a nationalist. It was the myopic and parochial political opponents that tried, in vain, to define him by his faith. The opposition ought to have known that a man whose wife is a Christian, whose children are allowed to practice their own faith, cannot be stereotyped by his faith.

This worldview of the candidate explains why throughout his campaign, he did not appeal to the base sentiments of his religion, he did not see himself as a Jihadist, unlike another candidate that rallied clerics to see the election as a ‘religious war’. Tinubu sold his programme of action to make our country better to voters, even when he was the target of unprecedented vitriolic attacks by opponents, the worst political behaviour ever witnessed in our political history.

When Tinubu chose Kashim Shettima, as his running mate, he was reawakening the spirit of June 12, 1993 presidential election, in which an Abiola-Kingibe combination resoundingly won the election. The victory was cruelly annulled by the military junta, led by General Ibrahim Babaginda.

When Tinubu chose Shettima, religion was not part of his political calculation. He was focused on a higher ideal, placing factors such as competence, innovation, compassion, integrity, fairness, and adherence to excellence, above religious sentiments.

Tinubu’s statement after announcing Shettima’s nomination as his running mate is worth recalling:

“I am mindful of the energetic discourse concerning the possible religion of my running mate. Just and noble people have talked to me about this. Some have counselled that I should select a Christian to please the Christian community. Others have said I should pick a Muslim to appeal to the Muslim community. Clearly, I cannot do both.

“Both sides of the debate have impressive reason and passionate arguments supporting their position. Both arguments are right in their own way. But neither is right in the way that Nigeria needs at the moment. As president, I hope to govern this nation toward uncommon progress. This will require innovation. It will require steps never before taken. It will also require decisions that are politically difficult and rare.

“If I am to be that type of President, I must begin by being that type of candidate. Let me make the bold and innovative decision not to win political points but to move the nation and our party’s campaign closer to the greatness that we were meant to achieve.

“Here is where politics ends, and true leadership must begin.

“Today, I announce my selection with pride because I have made it not based on religion or to please one community or the other. I made this choice because I believe this is the man who can help me bring the best governance to all Nigerians, period, regardless of their religious affiliation or considerations of ethnicity or region”.

The result of the election in all the six zones showed that Tinubu’s political calculation worked. Just like it worked for Abiola-Kingibe in 1993.

It was not true that Tinubu ‘roundly lost the ‘Christian South’ as Amanze wrote. Indeed there is no such geographical or demographic division in our country. While we have a preponderance of Christians in the South-East and South-South, we cannot say the same of the South-West where the two predominant faiths have adherents. Tinubu won the South-West, and had very poor number from the South-East because the voters erected an iron curtain against other candidates, except Peter Obi, who belongs to their ethnic stock. Tinubu also had a good showing in the South-South states of Edo, Delta, Cross River and Rivers, where he had, at least the mandatory 25 percent of the votes. Again, Amanze was wrong to say that Tinubu did not have ‘the right appeal’ to the voters in the entire three zones in Southern Nigeria, as the facts above have demonstrated. The only place where the voters were blinded about Tinubu was in the South-East and all Nigerians know why that was so.

In the second part of Amanze’s article that I read, it was shocking that Amanze was still peddling the egregious lie that Peter Obi and not Bola Tinubu won the election, even when third-placed Obi still have second place Atiku Abubakar to surpass to claim the trophy.

Let me say loud and clear. Obi lost the election. INEC did not scheme him out. The so-called popular impression about his purported victory was the product of an echo chamber of Obi’s supporters. You all hoped Obi would win, you even conducted fake polls, but the reality of Nigeria’s electoral map made all the pre-poll projections unrealistic.

Of the three major candidates, Obi had the narrowest path to victory. Outside his home base in the South-East, part of the South-South and Lagos, where he sprang an electoral upset, Obi only showed presence in the northern part of the country in the predominantly Christian states, such as Nasarawa, Plateau and Benue, where he was checkmated by Governor Hyancinth Alia, in favour of the APC candidate, now President Tinubu. In more populous North-West states, Obi was not in contention. He was a political paper weight. Similarly, in Kwara, Niger and Kogi states, Obi had scant appeal. He suffered similar fate in Adamawa, Gombe, Bauchi, Borno, Yobe and Taraba.

It is uncharitable and malicious for Amanze to attribute Tinubu’s victory to other factors other than his popularity with the voters. In the three horse race, Tinubu was the pre-eminent favourite of the Nigerian people.

Obi’s supporters who often adduce extraneous reasons to Obi’s political Waterloo, often forget the APC was in control of 21 states before the election. Polls by the APC before the election showed that our candidate was destined to win at the first ballot, despite all the obstacles of currency and petrol scarcity and the incumbent’s unpopularity in some parts of the country.

The election result was an upset of sort as we did not expect a tight race.

No one in his right senses would have expected Tinubu to come back empty handed in states under the control of his party. Despite the upsets in several states, our candidate was able to muster the votes that matter, pulling 25 percent of the votes in 30 states, leading in 11, recording tight race in Katsina, Sokoto, with the presumed ‘northern candidate’. Not to forget, our candidate reaped a political windfall from the crisis in PDP, which boosted his votes in Rivers and Oyo.

Amanze Obi should desist from spreading fantasies about the last election. Tinubu won it free and fair. “Popular impression” not based on hard facts, does not win any election. Any candidate who wants to win a general election must work hard to win plural votes in four of the six regions that make up the Federal Republic of Nigeria. Peter Obi succeeded only in two and fell seriously short in the other four.

I will end with this story about the 1979 election, which Shehu Shagari won. In Ogun State capital, Abeokuta, the popular impression was that Shagari’s National Party of Nigeria would sweep the polls. The party was the noisiest, the most visible in the city as it had in its fold many prominent sons of the town. But an opinion poll conducted by the PUNCH newspaper showed contrarily that Awolowo’s Unity Party of Nigeria was headed to victory. The election result affirmed pre-poll prediction and also affirmed that Shagari and Awolowo would emerge the two leading candidates.

The PUNCH poll was unlike the ‘arrangee’ polls conducted by Peter Obi and his friends before the election. The latter gave Obi’s supporters false hopes, false expectations of a forlorn victory. Amanze, it’s time to shake off your disappointment and quit the business of election fortune-telling.

-Onanuga is Special Adviser to President Tinubu on Information & Strategy

opinion

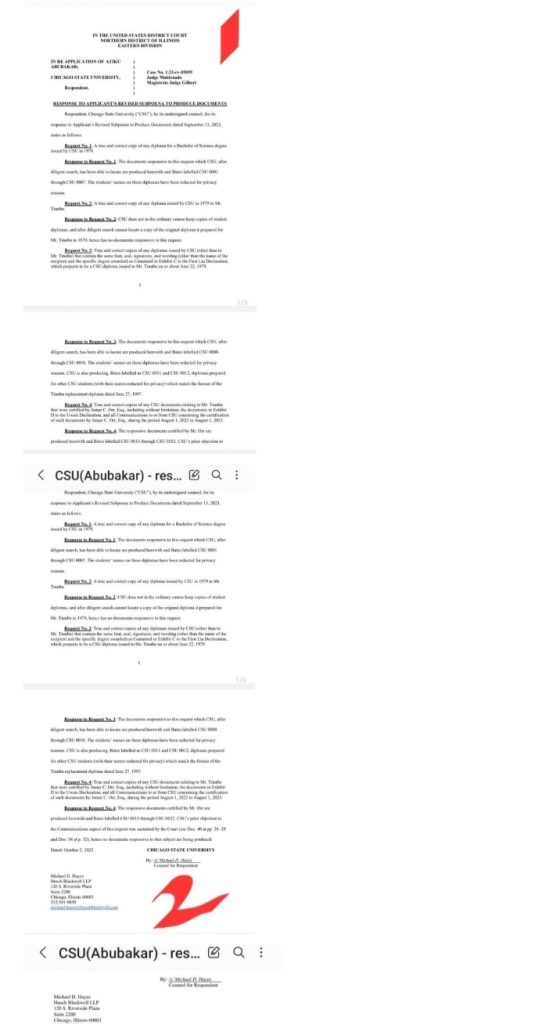

Breaking : Request by Atiku, CSU confirms Bola Tinubu graduated from school in 1979

The Chicago State University (CSU) has responded to the request by former vice president Atiku Abubakar in line with an Illinois, United States (U.S.) court order.

The Chicago State University (CSU) has responded to the request by former vice president Atiku Abubakar in line with an Illinois, United States (U.S.) court order.

In its response, the CSU insisted that it does not keep copies of diploma certificates issued to students.

It also confirmed that President Bola Ahmed Tinubu graduated from the school in 1979.

The CSU said Tinubu graduated in 1979 with a bachelors degree in Business Administration.

It, however, said that after diligent search it was able to find some but not give the names because of privacy concerns.

It further said that it could not find that of Tinubu which Atiku claimed was presented by the president to INEC.

The university said it found some diploma certificates with the same font as the one being queried by Atiku.

-

news4 years ago

news4 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

news1 year ago

news1 year agoEnvironmental Pollutions : OGONI COMMUNITY CRIES OUT, THREATENS TO SHUT DOWN FIRSTBANK,SHELL OIL COMPANY OPERATIONS FOR NOT PAYING COURT AWARD

-

news3 weeks ago

news3 weeks agoBreaking : TInubu appoints Bashir Ojulari as new CEO group of NNPC and GMD mele kyari get sacked, Says Onanuga

-

interview3 weeks ago

interview3 weeks agoNIGERIA MECHANIZED AGRO EXTENSION SERVICE PROJECT, A STRATEGIC MOVE TO ALLEVIATE POVERTY – DR. AMINU ABDULKADIR

-

news3 weeks ago

news3 weeks agoUpdate : Fubara ordered bombing of Rivers Assembly, I am not under duress I resigned, Says ex-Rivers HoS Nwaeke

-

news7 days ago

news7 days agoNothing new in FBI report on Tinubu, says Onanuga

-

news3 weeks ago

news3 weeks agoTinubu commended Nandap for her leadership, extends Comptroller-General tenure till 2026, says Onanuga

-

news2 weeks ago

news2 weeks agoUpdate : FG confirms continuation of crude, refined product sales in Naira initiative, Says Wale Edu