news

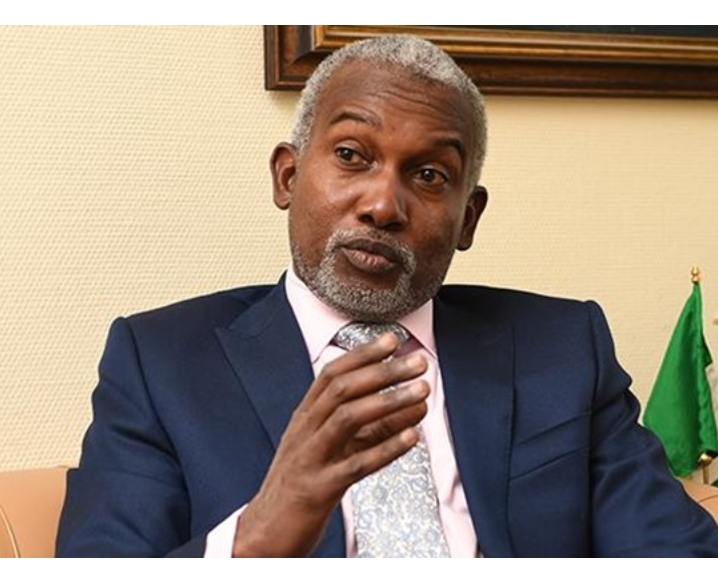

Just IN : Naira – for-Visa : Foreign Affairs Minister Yusuf, Directs all Embassies to comply with EFCC’s directive

Commission says some missions use N1,900 to dollar exchange rate

Commission says some missions use N1,900 to dollar exchange rate

Demands banks’ response to enquiries within 24 hours

Foreign Affairs Minister Yusuf Tuggar has written all the foreign missions in the country to comply with the directive of the Economic and Financial Crimes Commission (EFCC) to charge payment for visa and consular services in naira instead of dollar.

Tuggar has already met with a few envoys who sought more clarifications on the EFCC’s advisory.

It was learnt that the EFCC advisory against dollar-denominated service was necessitated in part after some embassies adopted N1,800-N1,900 exchange rates to a dollar.

An embassy was found to have set up an account unit where visa applicants were paying cash in dollar for services outside the conventional banking system.

Some embassies are understood to have started implementing the EFCC’s advisory on naira policy for consular services.

It was gathered that the EFCC has entered into an understanding with the Central Bank of Nigeria (CBN) for prompt remittance of the funds generated by the embassies to their home countries at official rate.

In an April 5, 2024 advisory to the Foreign Affairs Minister, the EFCC Executive Chairman, Mr. Ola Olukoyede, had asked government to stop foreign missions in Nigeria from charging visa and other consular services in foreign denominations.

He also advised all embassies to adopt Nigeria’s regulatory regime in fixing the exchange rate of the cost of their services.

He said the commission has observed the violation of Section 20(1) of the Central Bank of Nigeria Act, 2007 which makes currencies issued by the apex bank the only legal tender in Nigeria.

A top source told The Nation that the Minister of Foreign Affairs asked all foreign missions to implement the EFCC advisory.

EFCC urges embassies not to charge visa, other services in dollar

The source said: “The Federal Government has adopted the advisory of the EFCC which is backed by the CBN Act. In line with this, the Minister, Amb. Yusuf Tuggar, has formally written all embassies to charge and accept payment for visa and consular services in naira.

“In fact, the Ambassador of one of the missions collecting dollars for consular services demanded an audience with the Minister of Foreign Affairs for clarifications on the new policy. Tuggar, who met with the affected envoy, said there is no going back on the naira policy.

“But the EFCC has also reached an understanding with the CBN for the prompt remittance of all consular fees collected at the official exchange rate to the embassies or countries. The Federal Government will not default in remitting funds.”

It was gathered that the EFCC issued the advisory following discovery that some embassies had adopted N1,800 to N1,900 exchange rates for applicants for visa and consular services.

“Some embassies went beyond official and parallel market rates in fixing exchange rate for consular services. They were charging as high as N1,800 to N1,900,” one source said.

“A foreign mission was even collecting dollars in cash from visa applicants. The practice was outside the banking system.

“From feedback, some of the embassies are already charging for consular services, including visa, in naira. We will not relent in ensuring full compliance by all missions.

“There is a desk monitoring compliance with the naira-for-visa policy. Any infraction will be reported to the Federal Government through the Ministry of Foreign Affairs.”

The advisory, signed by the EFCC Executive Chairman, Mr. Ola Olukoyede, reads in part: “…I wish to notify you about the commission’s observation, with dismay, regarding the unhealthy practice by some foreign Missions to invoice consular services to Nigerians and other foreign nationals in the country in United States Dollar ($).

“This practice is an aberration and unlawful as it conflicts ‘with extant laws and financial regulations in Nigeria. Section 20(1) of the Central Bank of Nigeria Act, 2007 makes currencies issued by the apex bank the only legal tender in Nigeria.

“It states that ‘the currency notes issued by the Bank shall be the legal tender in Nigeria on their face value for the payment of any amount’.

“This presupposes that any transaction in currencies other than the naira anywhere in Nigeria contravenes the law and is therefore illegal.”

The commission added: “The refusal by some Missions to accept the Naira for consular service in Nigeria and also comply with foreign exchange regulatory regime in fixing the exchange of the cost of their services is not only illegal but represents an affront on the country’s sovereignty symbolised by the national currency. It undermines Nigeria’s monetary policy and aspiration for sustainable economic development.

“This trend can no longer be tolerated, especially in a volatile economic environment where the country’s macroeconomic policies are constantly under attack by all manner of state and non-state actors.

“In the light of the above, you may wish to convey the commission’s displeasure to all Missions in Nigeria and restate Nigeria’s desire for their operations not to conflict with extant laws and regulations in the country.

“Please accept, as always, the assurances of my highest consideration and respect.”

Attend to enquiries on money laundering, others within 24 hours, EFCC boss tasks bankers

The EFCC boss has also urged bankers to respond to the commission’s enquiries within 24 hours to aid its investigations.

“I don’t want to be charging banks alongside suspected criminals, because doing so can wreak havoc on the economy. It will even discourage investors from coming to the country,” Olukoyede said during a roundtable with compliance officers of banks in Ilorin, the Kwara State capital.

He added: “Our intention is to use the anti-corruption fight to bolster the economy. So, we must work together to save this country.”

Represented by acting Zonal Director, Ilorin Command Harry Erin, Pastor Olukoyede said: “We need to find a common ground to work together. You have a responsibility to fight corruption.”

The EFCC chair also expressed concerns over the use of fintech (private banking) by criminals to perpetuate crimes.

news

Update : FG confirms continuation of crude, refined product sales in Naira initiative, Says Wale Edu

The Federal Government has confirmed the crude and refined product sales in Naira initiative remains a standing national policy and will continue indefinitely.

The Federal Government has confirmed the crude and refined product sales in Naira initiative remains a standing national policy and will continue indefinitely.

However, the policy will stay in place as long as it serves the public interest and supports Nigeria’s broader economic goals.

This assurance was contained in the official X (formerly Twitter) handle of the Federal Ministry of Finance on Wednesday morning amid growing inquiries on the status of the policy.

The Ministry stated the initiative, first approved by the Federal Executive Council (FEC), is a long-term strategic directive and not a short-term or provisional measure.

According to the Ministry, stakeholders have reconvened to reiterate their full support and ongoing commitment to ensuring the successful implementation of the initiative.

The policy, which mandates the transaction of crude oil and refined petroleum products in Naira, is aimed at strengthening the country’s economic sovereignty, enhancing local refining capacity, and stabilizing the foreign exchange market by reducing the demand for dollars in domestic petroleum transactions.

The Ministry explained that this policy is structured to foster energy security and encourage investment in domestic refining infrastructure.

“The Crude and Refined Product Sales in Naira initiative is not a temporary or time-bound intervention, but a key policy directive designed to support sustainable local refining, bolster energy security, and reduce reliance on foreign exchange in the domestic petroleum market,” the statement reads.

While acknowledging that the transition involves complexities, the government admitted that existing challenges are being systematically addressed.

“As with any major policy shift, the Committee acknowledges that implementation challenges may arise from time to time. However, such issues are being actively addressed through coordinated efforts among all parties,” the Ministry said.

To assess the progress made and address lingering implementation issues, the Technical Sub-Committee on the Crude and Refined Product Sales in Naira initiative held a review meeting on Tuesday. The gathering brought together key figures involved in the execution of the policy.

Among the attendees were the Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, who chairs the Implementation Committee; and the Executive Chairman of the Federal Inland Revenue Service (FIRS), Mr. Zacch Adedeji, who heads the Technical Sub-Committee.

Also present were the Chief Financial Officer of NNPC Limited, Mr. Dapo Segun; the Coordinator of NNPC Refineries; Management of NNPC Trading; representatives from the Dangote Petroleum Refinery and Petrochemicals; and senior officials from the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), the Central Bank of Nigeria (CBN), and the Nigerian Ports Authority (NPA). A representative from Afreximbank and the Secretary of the Committee, Hauwa Ibrahim, also attended.

This policy, which aligns with the government’s broader economic reform agenda, is expected to support local content development, ease pressure on Nigeria’s foreign reserves, and provide a more predictable pricing structure for refined petroleum products in the domestic market.

The presence of major players from both the public and private sectors at the meeting shows the scale of collaboration required to sustain the policy. It also reflects the growing confidence in Nigeria’s shift toward economic policies that prioritize local capacity and currency resilience.

news

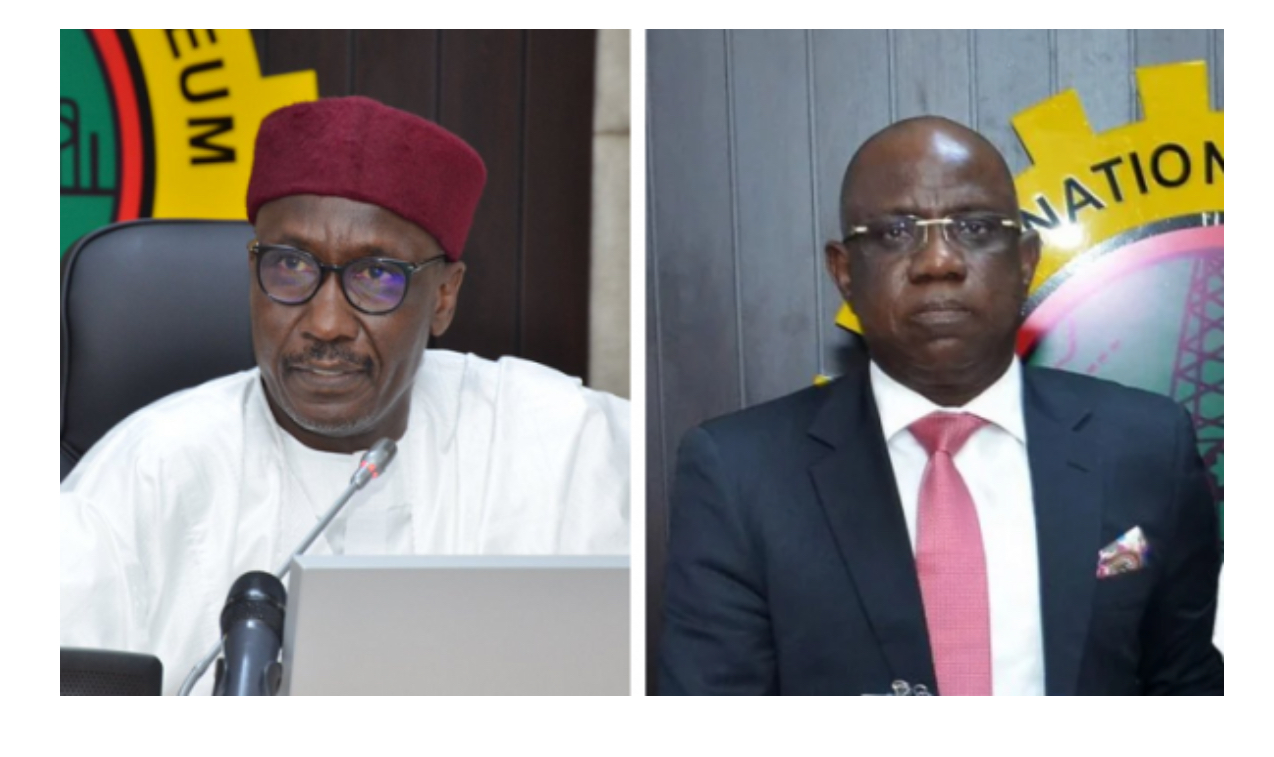

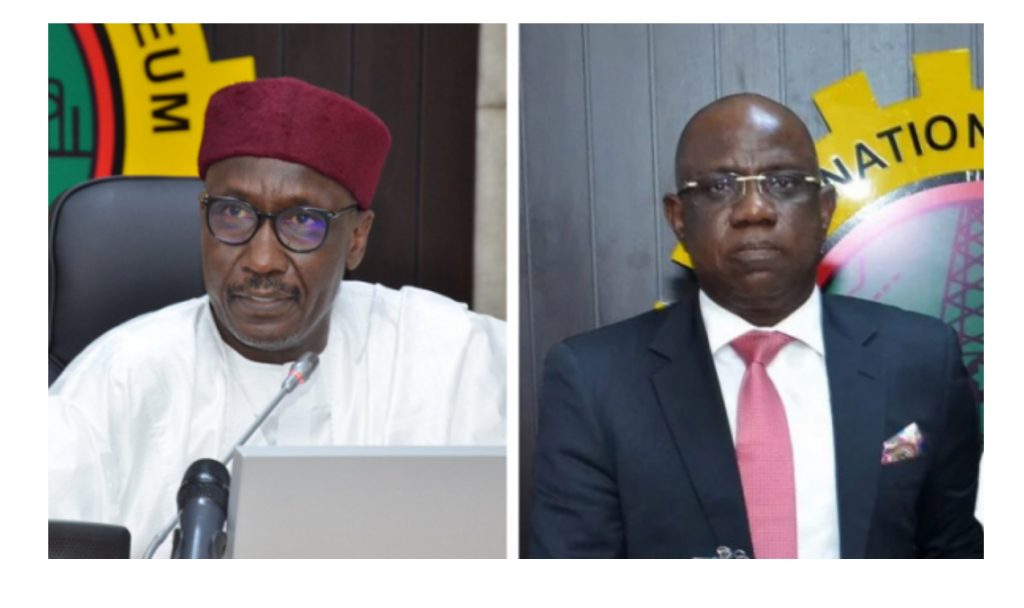

Breaking : TInubu appoints Bashir Ojulari as new CEO group of NNPC and GMD mele kyari get sacked, Says Onanuga

President Bola Tinubu has sacked the board of the Nigerian National Petroleum Company (NNPC) including its Group Chief Executive Officer, Mele Kyari and board chairman Pius Akinyelure.

President Bola Tinubu has sacked the board of the Nigerian National Petroleum Company (NNPC) including its Group Chief Executive Officer, Mele Kyari and board chairman Pius Akinyelure.

The decision, effective April 2, 2025, was announced in a statement by presidential spokesperson Bayo Onanuga.

President Tinubu cited the need for enhanced operational efficiency, restored investor confidence, and a more commercially viable NNPC as the driving forces behind the decision.

Invoking his powers under Section 59(2) of the Petroleum Industry Act (PIA) 2021, he reconstituted the board with new leadership aimed at repositioning NNPC Limited for greater productivity and alignment with global best practices.

Kyari was first appointed NNPC chief by former President Muhammadu Buhari but was reappointed in 2023 by President Tinubu.

As part of the overhaul, Bayo Ojulari takes over from Kyari as the new group CEO, while Ahmadu Musa Kida has been appointed as NNPC’s new non-executive chairman, replacing Pius Akinyelure. Also, Adedapo Segun has been confirmed as the company’s chief financial officer (CFO).

In line with the PIA, the president also appointed six non-executive directors from each geopolitical zone.

They include Bello Rabiu representing the north-west, Yusuf Usman from the north-east, and Babs Omotowa, a former managing director of the Nigerian Liquefied Natural Gas (NLNG), for the north-central.

Others are Austin Avuru for the south-south, David Ige for the south-west, and Henry Obih for the south-east.

Meanwhile, Lydia Shehu Jafiya, the permanent secretary of the federal ministry of finance, and Aminu Said Ahmed of the ministry of petroleum resources will represent their respective ministries on the new board.

“This restructuring is aimed at repositioning NNPC Limited for greater productivity and efficiency in line with global best practices. We are taking bold steps to transform the company into a more commercially driven and transparent entity,” the statement reads.

The changes take effect immediately, and the new board has been handed a strategic action plan, which includes a “review of NNPC-operated and Joint Venture Assets to ensure alignment with value maximisation objectives”.

news

Tinubu commended Nandap for her leadership, extends Comptroller-General tenure till 2026, says Onanuga

President Bola Tinubu has approved the extension of the tenure of the Comptroller-General of the Nigeria Immigration Service, Kemi Nandap, until December 31, 2026.

President Bola Tinubu has approved the extension of the tenure of the Comptroller-General of the Nigeria Immigration Service, Kemi Nandap, until December 31, 2026.

Nandap, who joined the NIS on October 9, 1989, was appointed as Comptroller-General on March 1, 2024, with an initial tenure set to end on August 31, 2025.

A statement by the president’s Special Adviser on Information and Strategy, Bayo Onanuga, on Monday, said for her leadership, noting improvements in border management, immigration modernisation, and national security under her watch.

“Under her leadership, the Nigeria Immigration Service has witnessed significant advancements in its core mandate, with notable improvements in border management, modernisation of immigration processes and national security measures.

“President Tinubu commended the Comptroller-General for her exemplary leadership and urged her to continue dedicating herself to the Service’s strategic priorities, which align with his administration’s Renewed Hope Agenda,” the statement read.

He also reaffirmed his commitment to supporting the NIS in safeguarding Nigeria’s borders and ensuring safe and legal migration.

-

news4 years ago

news4 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

news1 year ago

news1 year agoEnvironmental Pollutions : OGONI COMMUNITY CRIES OUT, THREATENS TO SHUT DOWN FIRSTBANK,SHELL OIL COMPANY OPERATIONS FOR NOT PAYING COURT AWARD

-

news1 week ago

news1 week agoBreaking : TInubu appoints Bashir Ojulari as new CEO group of NNPC and GMD mele kyari get sacked, Says Onanuga

-

news2 weeks ago

news2 weeks agoUpdate : Fubara ordered bombing of Rivers Assembly, I am not under duress I resigned, Says ex-Rivers HoS Nwaeke

-

interview1 week ago

interview1 week agoNIGERIA MECHANIZED AGRO EXTENSION SERVICE PROJECT, A STRATEGIC MOVE TO ALLEVIATE POVERTY – DR. AMINU ABDULKADIR

-

news1 week ago

news1 week agoTinubu commended Nandap for her leadership, extends Comptroller-General tenure till 2026, says Onanuga

-

brand2 weeks ago

brand2 weeks agoGTCO Plc Releases 2024 Full Year Audited Results …Pays Shareholders Record Dividend of N8.03k for 2024 Financial Year

-

brand2 weeks ago

brand2 weeks agoZENITHz BANK MAINTAINS SUPERLATIVE PERFORMANCE WITH PBT OF N1.3 TRILLION IN FULL YEAR 2024