news

The Messy Scandal Sheet of City Lawyer, Boardroom Guru and Business Mogul, TUNDE AYENI

-How he got enmeshed in serial multi-billion Naira mess.The truth about the former Skye Bank Chairman’s N150b fraud!

.How he milked Skye Bank dry!

+How his lawyers are fighting hard with their legalese for his release

Undisputedly astute businessman but now viciously embattled Tunde Ayeni, is a lawyer, investor and astute business magnate who sits atop the boards of a handful of successful and multinational companies in Nigeria and abroad as the Chairman. Little wonder, in the year 2011, mercurial and very business-minded Ayeni, was elected the Chairman of Skye Bank,[which was formed in 2005, when five commercial banks including Tunde Ayeni’s-owned and now moribund Bond Bank, merged to create a new entity with a balance sheet in excess of ₦1 trillion. Additionally, Ayeni was also the Vice Chairman of Aso Savings & Loans after emerging the majority shareholder in 2007. He also co-founded Ocean Marinse Security (OMS), a company that provides logistical support to the Nigerian Navy. Out of his deep knack for business, Tunde Ayeni became the Vice Chairman of Integrated Energy Distribution and Marketing Ltd (IEDM) in 2013, where he led a successful bid to take control of the Ibadan and Yola Electricity Distribution Companies. This marked the first privatization of a national energy asset in Nigerian history. He is also chairman of JKK (Nigeria) Plc and Temple Resources Ltd, and sits on the boards of PPP Fluid Mechanics Limited and Hightech Procurement Limited. On July 2016, Tunde Ayeni’s many dirty financial deals were exposed. It became a veritable and ugly news item for many, as the hitherto prudent businessman was exposed and tagged a controversial personality who can no more be trusted with people’s monies. Tunde Ayeni, who had his fingers burnt when the Economic and Financial Crimes Commission arrested and detained him for alleged financial fraud running into N8 billion which he allegedly committed as the Chairman of Skye Bank now Polaris Bank. Immediately men of the EFCC got hold of Ayeni and remanded him in their custody, several allegations were rolled out against this Iyah-Gbede, Ijumu, Kogi State-born boardroom guru, Tunde Ayeni. These ranged from his free-spending and massive attitudes at parties and events, to lavishing huge amount of money on frivolities like fleet of automobiles of different makes and brands, flamboyantly spending and using his position as a bank Chairman to grant loans for close family members, cronies, friends and aides which later resulted into un-serviced loans and many other financial misappropriations. We also gathered that other companies chaired by Tunde Ayeni were not left out of this financial turmoil and flagrant abuse of office by Ayeni. The companies were also reported to have felt the heat then. For example, his then fledgling ntel, a telecoms outfit, could not meet up with the information and communication needs of Nigerians, due to scarcity of funds for its smooth take-off and rewarding operations. But the worst hit by Tunde Ayeni’s financial carelessness, recklessness and ruthlessness, was the Skye Bank. Realizing how dangerous Ayeni’s financial modus operandi could be to the well-being of the bank, the EFCC stepped briskly into the issue and pronto, Ayeni was whisked away by the anti-graft agency. Furthermore, the EFCC later filed very damning charges against Tunde Ayeni before a Federal High Court in Maitama, Abuja in the Federal Capital Territory. Ayeni was variously charged by the EFCC for mismanaging the funds of Skye Bank which thereafter, ultimately led to its collapse. Back then, the Managing Director and Chief Executive of the Nigeria Deposit Insurance Corporation, Alhaji Umaru Ibrahim, had disclosed that Ayeni and a former Skye Bank Managing Director, Timothy Oguntayo, are being investigated for their shady roles in the financial fraud that rocked the bank. While Tunde Ayeni’s investigations and cross-examinations were on-going, the Central Bank of Nigeria, NDIC and AMCON revoked the operating license of Skye Bank. This was due to the bank’s financial instability, thus necessitating the regulators to rename it Polaris Bank with a capital injection of about $2bn. 51-year-old Ayeni chaired the board of Skye Bank between the years 2010 to 2016 before his removal by the Central Bank of Nigeria (CBN). Moreover, Ayeni was also investigated for illegally injecting a whopping N3 billion (three billion naira) into the re-election campaign of former President Goodluck Jonathan. Controversial Tunde Ayeni was also accused to have used his position to obtain loans to purchase ntel, take up power distribution with the establishment of Ibadan Electricity Distribution Company and Yola Electricity Distribution Company. All these allegations were all put up against Tunde Ayeni at the Court of Law then and the Kogi-born businessman found himself in huge financial quagmire. The then AMCON Managing Director, Ahmed Kuru was said to have included Tunde Ayeni as one of the debtors of a whopping N906 billion naira. When Skye Bank was founded in 2005, the financial institution has been serially plundered by its key management figures. However, the coming on board of former Inspector General of Police, Musiliu Smith as the bank’s chairman brought a new dimension into the operation of the bank affording the financial institution to be able to plod along impressively keeping its nose as clean as whistle. But, like a twist of fate, the successor to Musiliu Smith, Tunde Ayeni a parvenu oil and gas magnate as the Chairman of the bank ushered in an era of derring-do, dodgy financial gymnastics and kamikaze deposit plundering. In a letter written then to the Acting President the new Central Bank of Nigeria- appointed Board the bank has alleged that Ayeni was indebted to the bank by a staggering and largely unrecoverable N150 billion.

In a letter written to the then Acting President the Central Bank of Nigeria- appointed Board the bank alleged that Ayeni was indebted to the bank by a staggering and largely unrecoverable N150 billion. If any Nigerian bank in contemporary times had ever been thoroughly ravaged and assaulted by its board Skye takes the lead. Two of the larger banks in the 2005 merger were EIB bank and Prudent bank run by Sola Akinfemiwa. The Central Bank of Nigeria-inspired banking sector consolidation of the time afforded these bank executives to consolidate their interests in a bigger, and what they hoped to be a more stable institution.

The consolidated banks were Prudent Bank Plc, EIB International Plc, Bond Bank Limited, Reliance Bank Limited and Co-operative Bank Plc. Ironically, Ayeni was instrumental to the evolution of the bank, as he was said to have used various bank loans to buy Mainstreet Bank for N135 billion from AMCON and merged it with Skye Bank to form a bigger franchise.

Ayeni, a constant, but highly influential figure in former President Goodluck Jonathan’s government, had spiritedly leveraged on his closeness to Jonathan, the now late former governor of Bayelsa State Deprieye Alamaesiagha and Diezane Alison-Madueke, former petroleum minister to make significant economic gains for himself through ruthless takeovers and deals, either as a proxy for the alleged triumvirate or as the main deal maker.For instance, he allegedly purchased Nitel/Mtel at $252 million, a cost well below the actual value of the moribund parastatal. According to reports, he owns the consortium that bought over Ibadan Electricity Distribution Company as well as the Yola Distribution Company, at also prices well below their intrinsic valuation. In 2012, he became the chairman of Skye Bank and significantly leveraged on his position on the board to pillage the bank to fund a bohemian lifestyle, often using the bank’s funds to make oil sector investments with uncertain prospects; a situation which a source that preferred not to be mentioned in print confided had depleted the Bank’s general reserves by a whopping N48bn. Little wonder his speculated N3 billion donation to the President Goodluck Jonathan reelection campaign caused so much anxiety among Skye Bank customers who, for fear of safety of their savings, went on panic withdrawals when the news broke.

Recently, the Management of Skye Bank Plc has reportedly written to Acting President Yemi Osinbajo, detailing how Tunde Ayeni, Chairman of the bank between 2010 and 2016, wrecked havoc on the institution. In a deluge of letters and documents, the Management listed details of how Ayeni allegedly used his office to perpetrate illegality and fraud that nearly brought the bank to its knees. The apex bank had watched the Skye Bank saga with bated breath, but after several warnings, the Central Bank of Nigeria (CBN) took over Skye Bank on July 4, 2016. Godwin Emefiele, governor of CBN, said at the time that the action followed the failure of the lender to meet the regulator’s minimum key liquidity and capital adequacy ratios.

Ayeni had resigned following the development, and CBN announced the appointment of Muhammad Ahmad as the new chairman, while Adetokunbo Abiru took over from Timothy Oguntayo as group managing director (GMD.) In a letter signed by Abiru and Ahmad, the bank presented in graphic details how Ayeni allegedly used loans from the bank to acquire major government companies. The letter was unsparing of the debauchery committed at the bank under Ayeni’s controversial chairmanship. “Upon the assumption of duty by the new board, one of the immediate concerns that needed to be addressed was to ascertain the true state of the affairs and financial position of the bank and the credibility of the IT and information systems of the bank,” the letter read. To this end, the following were undertaken: engagement of PWC does to half-year audit as of June 30, 2016. This was later extended to cover the full year to December 31, 2016.

“The engagement of KPMG to do a forensic audit of the bank’s IT platform and management information systems; and The forensic audit revealed that the bank operated two sets of financial books and this was responsible for the regulators/auditors inability to detect the massive losses and infractions, particularly the balance of N280bn in suspense accounts. The bank’s total exposure to Ayeni as of the date is about N70bn. It is clear that he used his position as the chairman of the bank to obtain inside loans well above the regulatory thresholds for the acquisition of the following government enterprises: Ibadan Electricity Distribution Company, Yola Ibadan Electricity Distribution Company and Nitel/Mtel. All the facilities are presently seriously challenged. As of today, Ayeni’s total industry indebtedness, covering both Nitel and the Electricity Distribution Companies (Discos) is estimated at about N150bn, and little, if any, of these obligations are being adequately serviced, it is doubtful that he will ever be in a position to service these loans satisfactorily.” The expository letter also hinted at another N33billion traced to Ayeni, with strong suspicion that out of this amount, N7 billion was spent on the re-election campaign of former President Goodluck Jonathan.

The sum of N7bn was disbursed without due process to various individuals and corporate organizations on the request of Godknows Igali, a former permanent secretary of the federal ministry of power,” it read. “The monies appear to have been spent essentially on the Jonathan-Sambo electoral campaign in 2015. That sum remains outstanding as at today. “There is ample evidence that he (Ayeni), among others, received large amounts of cash, totaling N29.5bn, from the bank, which appears to be connected to the purchase of Mainstreet Bank Limited, but which has not been accounted for. In the face of this monumental rape, the Management has appealed to the government to assist it to seize Ayeni’s assets. “The former chairman should be brought to account for his central role in many of the identified infractions,” it read. “We have been able to perfect the debenture on the fixed and floating assets of Natcom, the vehicle that was used for the acquisition of Nitel and Mtel with asset estimated at N282bn (Open market value) and N183bn (forced sale value) by Knight Frank in 2014. This will put us in a position to place the company into receivership for recovery. However, in order to come to fruition, this approach will require strong and unyielding support from the regulatory and political authorities in the country.” The management also indicted Akinsola Akinfewa, Kehinde Durosinmi-Etti and Timothy Oguntayo, all former GMDs of the bank. Other individuals listed in the petition for various acts of infraction are Femi Otedola, chairman Forte Oil Plc, Festus Fadeyi and Jide Omokore. Recall that agents of the Economic and Financial Crimes Commission (EFCC) had in the past arrested and detained Tunde Ayeni, Skye Bank’s erstwhile Chairman, over allegations that he allegedly bribed a former minister of the Federal Capital Territory (FCT), Bala Mohammed, to acquire 54 plots of land in Abuja, the Nigerian federal capital city. Two EFCC sources informed some media guys at the time, that at his arrest, he was initially reluctant to co-operate. He had earlier been investigated for playing various roles in different business deals involving former First Lady Patience Jonathan and a former head of state, Abubakar Abdulsalam, who co-owns a telecommunications company with the former bank Chairman. Already, the Management of Skye bank is reportedly seeking to take over some oil wells belonging to Jide Omokore, a businessman involved in a number of corruption cases within and outside Nigeria. The bank said Omokore is indebted to it to the tune of N110bn at an exchange rate of $1/N315. The loans in question were said to have been obtained through three companies namely: Atlantic Energy Drilling Concepts (N56 billion), Cedar Oil and Gas Ltd (N22.4 billion) and Real Bank Ltd (N31 billion.) The new management of Skye bank has claimed that the repayment of two major obligations of the oil companies is tied to the controversial strategic alliance agreements (SAAs) with the Nigerian National Petroleum Corporation (NNPC.) Atlantic Energy was awarded SAAs by the Nigerian Petroleum Development Company (NPDC) Ltd, a subsidiary of NNPC, to develop and finance production from OMLs 26, 42, 30 and 34 – four oil blocks in all – in 2011.NPDC valued its stake in the oil wells at $1.8 billion then. The Economic and Financial Crimes Commission (EFCC) has frozen the assets of Omokore over suspicion of money laundering and procurement fraud.

In the letter to the Acting President, Skye bank has appealed that the federal government grant it access to the assets that were funded with loans from the bank.

“We will require assistance for the extrication of the real estate assets that were fully funded with loans from the bank from the assets of Omokore presently under the forfeiture order from the court,” the letter read. “This will enable us have access and rights over these assets and put the bank in a position to realize the assets that form the collateral for the loans granted to Real Bank limited.” The bank also sought assistance to take control of the oil assets of Omokore.

“We will require some political intervention working with the NNPC to be able to bring this matter relating to Atlantic Energy to a quick resolution,” the letter read

Skye Bank is struggling to survive, but analysts doubt its capacity to stay afloat given deep depositor suspicion of its solvency, its high and rising interest expenses relative to interest income and its evidently narrowing net interest margin. Victor Ukpai, a Research Analyst at Focus Bank, points out that a critical problem at Skye Bank was the apparent weakness of corporate governance, ‘those that should have given oversight integrity and corporate direction were the wolves at the gate’, he notes. According to Ukpai, ‘the regulatory bodies need to be a lot more thorough and circumspect in approving board positions of banks, detailed security checks and other ancillary means of intelligence gathering should be conducted before the approval of board members, only recently two prospective members of the board of an anti corruption agency were found to be under investigation by that very same agency!’. Skye Bank may not topple over but the outlook appears bleak as the two Kogi state indigenes of Tunde Ayeni and Jide Omokore, have dealt severe blows to the banks underlying liquidity and its supporting business capital. After the whole scenario then, an FCT High Court in Maitama ordered the Economic and Financial Crimes Commission (EFCC) to immediately release the Tunde Ayeni. The then trial judge, Justice Yusuf Halilu held that the anti-graft agency had suppressed facts which misled the court into earlier granting the application, thereby, making the detention illegal. The decision of the court followed an enforcement of fundamental rights suit filed by Ayeni, through his counsel, Ahmed Raji (SAN) seeking his release from the EFCC custody. At that period, Raji told the court that there was a pending suit before the Federal High Court against Tunde Ayeni on the same subject matter and that the trial judge at the Federal High Court then, Justice Nnamdi Dimgba had in the particular case admitted his client to bail. He added that the bail condition had since been perfected. Raji added that the detention of the applicant was a breach of his fundamental human right as he went to the commission by himself on invitation. When Ayeni’s case was on at the court, several revelations were made which included that Ayeni as the then Chairman of Skye Bank in connivance with the then Managing Director and Chief Executive Officer, Timothy Oguntayo conspired at different times to steal huge cash amounting to a whopping N4,750,000:00 (Four Billion, Seven Hundred and Fifty Million Naira) and USD5,000,000 (Five Million United States Dollars) belonging to Skye Bank Plc. According to information made known to the press by the court then, this sinful act of Tunde Ayeni and Oguntayo was contrary to the provisions of Section 1(a) of the Money Laundering (Prohibition) Act 2011 (as amended) read together with Section 18 (a) of the Money Laundering (Prohibition) Act 2011 (as amended) and punishable under Section 16(2) (b) of the Money Laundering (Prohibition) Act 2011 (as amended.)” However, seeing that the issue may land him in jail and destroy his ‘hard earned’ image, Ayeni involved the services of highly respected legal practitioners like Wole Olanipekun, Dele Adesina etc. to battle for his soul. These lawyers fought tooth and nail with the EFCC and Tunde Ayeni was given a controversial bail in the sum of N50 million with two sureties in like sum then. Oguntayo, through his own counsel, Oyetola Oshobi was also given the same bail condition. This was how Tunde Ayeni’s lawyers ensure he continue to breathe free air till date even though he has lost his credibility in the comity of businessmen and boardroom tycoons both in Nigeria and the international business community. How Tunde Ayeni will escape the gulag given the monumental and ground-swelling allegations and fraudulent charges against him, will take the courts of law to do the needful legally and appropriately.

news

Breaking : TInubu appoints Bashir Ojulari as new CEO group of NNPC and GMD mele kyari get sacked, Says Onanuga

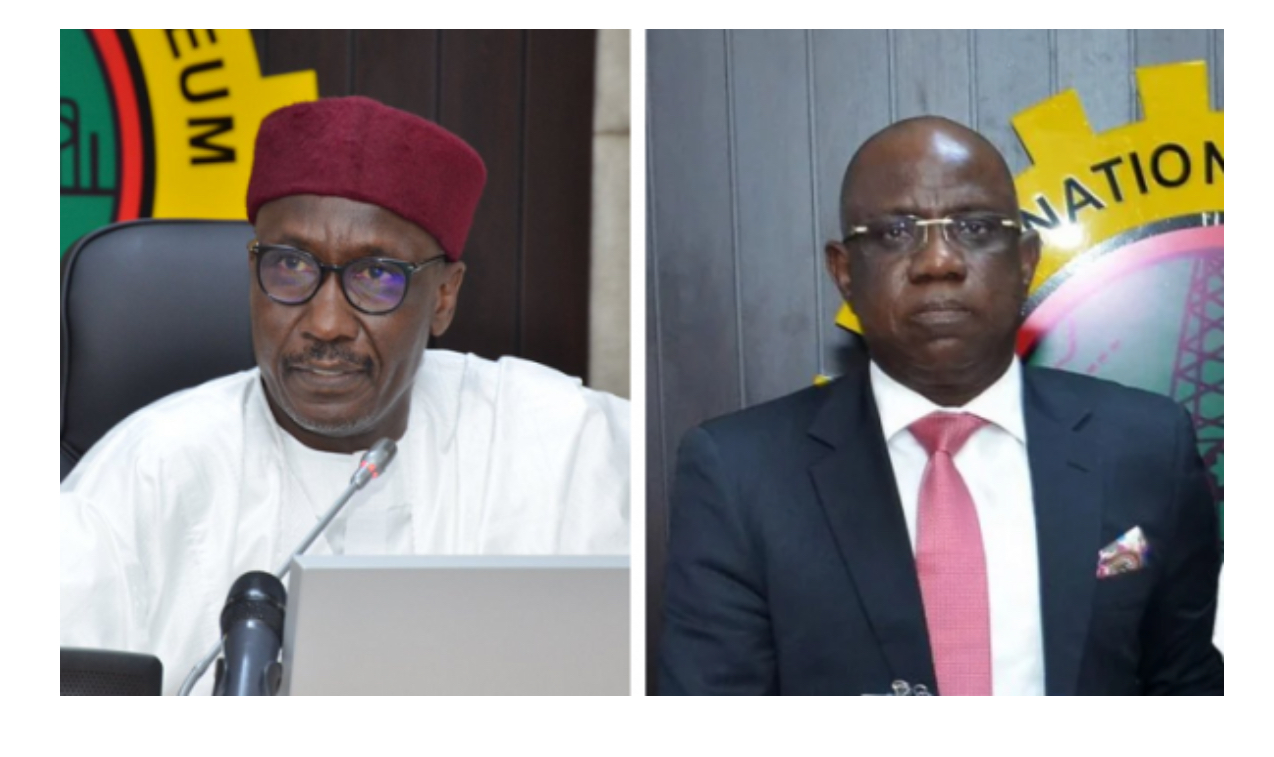

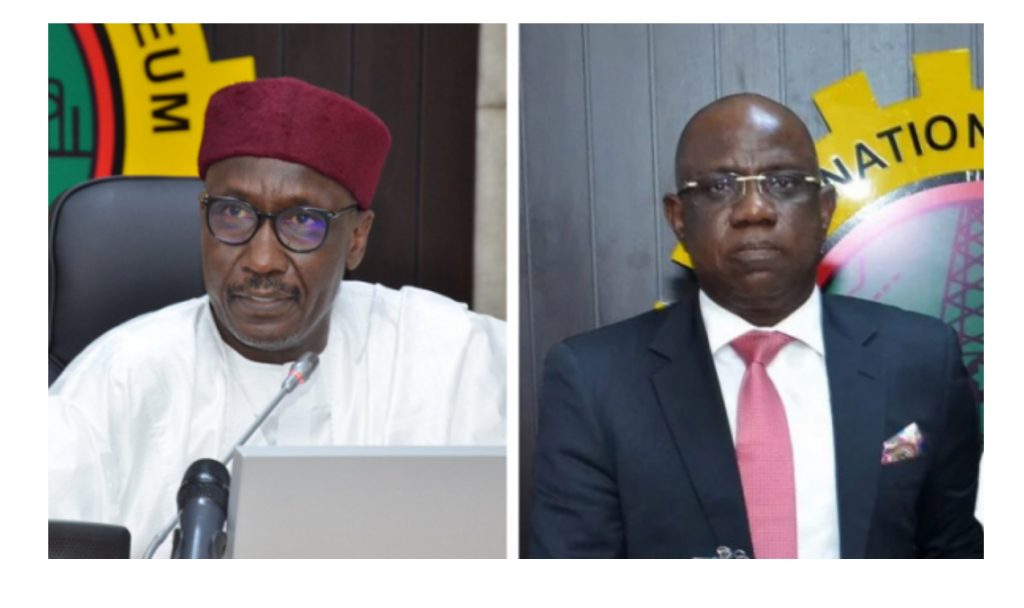

President Bola Tinubu has sacked the board of the Nigerian National Petroleum Company (NNPC) including its Group Chief Executive Officer, Mele Kyari and board chairman Pius Akinyelure.

President Bola Tinubu has sacked the board of the Nigerian National Petroleum Company (NNPC) including its Group Chief Executive Officer, Mele Kyari and board chairman Pius Akinyelure.

The decision, effective April 2, 2025, was announced in a statement by presidential spokesperson Bayo Onanuga.

President Tinubu cited the need for enhanced operational efficiency, restored investor confidence, and a more commercially viable NNPC as the driving forces behind the decision.

Invoking his powers under Section 59(2) of the Petroleum Industry Act (PIA) 2021, he reconstituted the board with new leadership aimed at repositioning NNPC Limited for greater productivity and alignment with global best practices.

Kyari was first appointed NNPC chief by former President Muhammadu Buhari but was reappointed in 2023 by President Tinubu.

As part of the overhaul, Bayo Ojulari takes over from Kyari as the new group CEO, while Ahmadu Musa Kida has been appointed as NNPC’s new non-executive chairman, replacing Pius Akinyelure. Also, Adedapo Segun has been confirmed as the company’s chief financial officer (CFO).

In line with the PIA, the president also appointed six non-executive directors from each geopolitical zone.

They include Bello Rabiu representing the north-west, Yusuf Usman from the north-east, and Babs Omotowa, a former managing director of the Nigerian Liquefied Natural Gas (NLNG), for the north-central.

Others are Austin Avuru for the south-south, David Ige for the south-west, and Henry Obih for the south-east.

Meanwhile, Lydia Shehu Jafiya, the permanent secretary of the federal ministry of finance, and Aminu Said Ahmed of the ministry of petroleum resources will represent their respective ministries on the new board.

“This restructuring is aimed at repositioning NNPC Limited for greater productivity and efficiency in line with global best practices. We are taking bold steps to transform the company into a more commercially driven and transparent entity,” the statement reads.

The changes take effect immediately, and the new board has been handed a strategic action plan, which includes a “review of NNPC-operated and Joint Venture Assets to ensure alignment with value maximisation objectives”.

news

Tinubu commended Nandap for her leadership, extends Comptroller-General tenure till 2026, says Onanuga

President Bola Tinubu has approved the extension of the tenure of the Comptroller-General of the Nigeria Immigration Service, Kemi Nandap, until December 31, 2026.

President Bola Tinubu has approved the extension of the tenure of the Comptroller-General of the Nigeria Immigration Service, Kemi Nandap, until December 31, 2026.

Nandap, who joined the NIS on October 9, 1989, was appointed as Comptroller-General on March 1, 2024, with an initial tenure set to end on August 31, 2025.

A statement by the president’s Special Adviser on Information and Strategy, Bayo Onanuga, on Monday, said for her leadership, noting improvements in border management, immigration modernisation, and national security under her watch.

“Under her leadership, the Nigeria Immigration Service has witnessed significant advancements in its core mandate, with notable improvements in border management, modernisation of immigration processes and national security measures.

“President Tinubu commended the Comptroller-General for her exemplary leadership and urged her to continue dedicating herself to the Service’s strategic priorities, which align with his administration’s Renewed Hope Agenda,” the statement read.

He also reaffirmed his commitment to supporting the NIS in safeguarding Nigeria’s borders and ensuring safe and legal migration.

news

Update : Fubara ordered bombing of Rivers Assembly, I am not under duress I resigned, Says ex-Rivers HoS Nwaeke

• Says suspended gov plotted Tinubu’s downfall through pipeline bombings

• ‘Fubara ordered Ehie to pull down Assembly to avert impeachment’

• Nwaeke links Bala Mohammed to sinister plot against President

• Says emergency saved Rivers, Nigeria from major disaster

The immediate past Rivers State Head of Service, Dr. George Nwaeke, yesterday gave what appears to be yet the most revealing insider’s account of some of the events that culminated in the March 18 suspension of Governor Siminilayi Fubara and the state Assembly for six months.

Nwaeke, who claimed to have been an eyewitness to some of the actions taken by Fubara, spoke of how the suspended governor allegedly plotted the destruction of the State House of Assembly and economic sabotage to ensure the downfall of President Bola Tinubu.

Nwaeke, in a video press conference and a statement, claimed that Fubara masterminded the bombing of the state House of Assembly, using his Chief of Staff, Edison Ehie.

Nwaeke was appointed as head of service by Fubara.

He said he was prompted to set the records straight following “the loads of misinformation on print and electronic media.”

He said he was not sacked neither or pressured to resign but resigned “willingly from the depth of my heart.”

He said: ”However, as an insider and a key player in this administration by my position, who worked closely with Siminilayi Fubara, it will be unfair for me to keep silent or not to address some key factors that has affected or will affect our state if we continue on this trajectory.”

He thanked the President for “a swift intervention in Rivers State crisis, especially on the state of emergency that was declared and assented to by the National Assembly.”

He added: “You will recall that when the governor was suspended, as the head of service, I was the next in command. So I am not speaking from outside, I am speaking as an insider.

“If not for the intervention of Mr. President, Nigeria would have faced the worst economic sabotage and Rivers State would have been up in flames.

“First, it all started with the Rivers State House of Assembly where the Governor, Siminilayi Fubara, directed his Chief of Staff (Edison Ehie) to burn down the assembly in a way to avert his impeachment.

“That evening, Edison was in Government House with two other boys, including the former Chairman of Obio/Akpor LGA, one Chijioke. I was there with them when a bag of money was handed over to Edison for that operation, though I do not know the amount inside.

“I want to tell Rivers people today that the House of Assembly complex in Moscow Road was clearly brought down by Edison Ehie under the instructions of Governor Siminilayi Fubara, I challenge him to an open confrontation and I will throw more light on it.

“A day after that incident, I almost resigned, but I was very scared because I know the power of a sitting governor and he knew that I am aware of the whole plan and that I am discomforted with the unconscionable act and deliberate posture of innocence and mien of a sheep.”

He also alleged that another attempt was made to “destroy the residential quarters of the House of Assembly members.”

Continuing, he said: “If not for the press conference that was held there by Rivers youths, Rivers elders and National Assembly members, that would have been another barbaric demolition in Rivers State.

“I came to realise that they actually wanted to demolish that second building, because after some weeks, he personally told me that if he knew early, he would have gone to pull down their hall before visiting the residential quarters of the assembly, and that he didn’t actually know that they had such a beautiful hall where they are using now for their sitting.

“I was shocked and I asked myself how could a man that wants to lead his people be destroying his state assets and wasting public funds on a needless ego fight.”

Nwaeke appealed to critics of the declaration of emergency rule by President Tinubu to retract their statements, saying without the urgent intervention, a lot of things would have gone wrong in the state.

Such critics, according to him, ”are only seeing the surface. If the President did not take proactive step, no one knows who would have been affected by the sinister plans that were cooking.”

He asked the President “not to give up on Rivers State affairs because a lot is going on there with Governor Fubara.”

He said one of the factors that “got me removed was when Governor Fubara told me that they would use the Ijaw to decide who would become the next president of Nigeria, and I asked him how will that work? Is it by votes or by what means?”

On alleged plan to shoot down the second term of President Tinubu, Nwaeke said: “He clearly told me that he is the chief security officer of Rivers State and his brother is in charge of Bayelsa State, and all the pipelines are under their care; that at the appropriate time, they would tell the boys what to do, and fund was not an issue.

“That was why when he made that statement in his public function that “I will tell the boys what to do at the appropriate time” I knew something was up and perhaps the time was near.

“He boasted to be the ‘David that will bring down the Goliath of Rivers State.’ That he has the backing of the cream-de-la cream in the state.

“The plan was to start from non-Ijaw speaking areas to destroy oil facilities to remove attention from the Ijaw and make it have a statewide look. The Ogoni, Oyibo, Ahoda areas were to be bombed first before the Ijaw zones. This would have brought down the government of President Tinubu and usher in a new President from the coalition of political parties with a Vice President from the Ijaw.

“The media was to be captured by paying heavily for airtime and retaining the social media influencers and known social critics on their payroll.

“I am not unaware of what this revelation means, but I am doing this to free my conscience and warn those innocent persons that are used to sway public sentiment that there is more than meets the eye in the Rivers matter.

“Sometimes I slept over in Government House. But I started being uncomfortable when Governor Bala Mohammed and some other stakeholders started nocturnal visits to Rivers State.

“I recall after one of such visits he told me that he would support Bala Mohammed or any other northerner for president; that discussions were ongoing.

“Although I was not bothered about whom he supports, I was more concerned about the quantum of state resources that he releases to these visitors at each visit.”

Nwaeke asked the Nigeria Labour Congress (NLC) to call their Rivers labour leaders to order to avoid politicising labour in the state.

He said he was privy to several private meetings between the governor and labour leaders in the state and the largesse that accompanied each meeting to compromise the Labour Union.

“More worrisome is several meetings between the governor, his chief of staff and some militant leaders. The details of which meetings I was not privy to since I was not allowed into the meetings.

“However, each meeting ended with huge sums of money paid to attendees.”

He said Rivers people and the generality of Nigerians are “the beneficiary of the declaration of state of emergency rule in Rivers State and not Governor Fubara or Minister Wike.”

He stressed the need for the state’s Sole Administrator, Vice Admiral Ibok-Ete Ibas (rtd), to “step up his guards and be very vigilant, because I am aware of the sinister arrangement and dastardly plans to continue to hatch their plans if not put in check.”

He said: “This accounts for the organised media condemnations and seeming public outcry against Mr. President and National Assembly.

“Those who love democracy and humanity will always protect humanity and democracy. Mr. President, you have just protected democracy and humanity in Rivers State. I can now sleep with my conscience clear.”

Wike slams NBA for ‘hypocrisy’ on state of emergency

Federal Capital Territory (FCT) Minister Nyesom Wike yesterday faulted the Nigeria Bar Association’s (NBA) stance that the declaration of state of emergency in Rivers by President Bola Tinubu was unconstitutional and illegal.

Wike alleged that the NBA discredited Tinubu’s decision because the Rivers Government had promised to host its annual general conference.

The minister stated this when officials of the Body of Benchers, led by its Chairman, Chief Adegboyega Awomolo (SAN), visited him in Abuja.

He added that the association did not support the declaration of the state of emergency because there would be no money to give to the NBA for the conference.

“What kind of hypocrisy is this?” he queried.

The minister called on the Body of Benchers to call the NBA to order over the association’s unnecessary criticism of the judiciary.

He said that the body should not sit and watch, while the NBA and its members destroy the legal profession.

He said that some of the members of NBA, often without reading a judgement, go on national television to condemn the judgment and criticise the judges.

He said that such actions have continued with no sanction.

“If you don’t discipline somebody, nobody will learn any lesson.

“We shall no longer allow our profession to be pulled down. I cannot believe, as a lawyer, that you make a contribution to help the legal profession, and you will be criticised by your fellow lawyers.

“Sir, time has come that we need to say look, enough is enough. We cannot continue to discourage our judges and justices. It is not done anywhere.

“I have never seen where members of a profession are the ones that are bent on bringing the profession down,” he said.

The minister also accused the NBA of describing any support rendered by the executive arm of government to the judicial arm as a bribe.

Wike recalled that when NBA was building its National Secretariat, the leadership wrote to the executive for support, adding that nobody saw that as a bribe.

“I was the only one who contributed to the NBA to build the National Secretariat. The NBA didn’t see it as a bribe.

“When you contribute to the Body of Benchers, it is a bribe, but when you contribute to NBA, it is not a bribe, they will take it.

“The same NBA will rely on state governments to sponsor their activities, but when the state government supports the judiciary it is bribery,” he added.

Wike said that the constant taunting of judges and justices had made them to avoid attending social gatherings or going to church or mosque for fear of molestation.

He added that judges could no longer shake people’s hands freely because lawyers would accuse them of collecting bribes.

“It has gotten to the stage that our Judges are so scared of going to a mosque or church or even greeting somebody they know because of fear of bribery.

“They run away from shaking people’s hands because they will start accusing them of collecting bride. This must stop,” he said

The immediate past Rivers Head of Service, George Nwaeke, has denied claims by his wife, Florence, that he was kidnapped and under duress.

Nwaeke, who recently released chilling allegations against suspended Governor Siminalayi, said contrary to his wife’s emotional outbursts, he was safe in Abuja.

He disclosed that he went to Abuja to voluntarily report himself to security agencies over the ongoing crisis in Rivers State.

The former HoS spoke in a trending video released early hours of Saturday.

He insisted thatwife’s claim was false and suggested that she had been misled and given a script to read.

He said: “I am in Transcorp Abuja. I arrived this morning from Port Harcourt to meet security agencies and report myself, as well as the troubling events happening in Rivers State. I resigned as Head of Service on Monday because of these developments”.

Addressing his wife, he said: “I just saw a video of my wife trending. She was told I had been kidnapped and given a script to read. I want to make it clear—I am not kidnapped. I am in Abuja, working.

“When I was Head of Service, my wife was not involved in my official duties. That script she read is null and void. I am safe and sound. I will report myself to the appropriate security agencies because Abuja houses their headquarters, and I feel safer making my report here.”

-

news4 years ago

news4 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

news6 days ago

news6 days agoUpdate : Fubara ordered bombing of Rivers Assembly, I am not under duress I resigned, Says ex-Rivers HoS Nwaeke

-

news1 year ago

news1 year agoEnvironmental Pollutions : OGONI COMMUNITY CRIES OUT, THREATENS TO SHUT DOWN FIRSTBANK,SHELL OIL COMPANY OPERATIONS FOR NOT PAYING COURT AWARD

-

news2 days ago

news2 days agoBreaking : TInubu appoints Bashir Ojulari as new CEO group of NNPC and GMD mele kyari get sacked, Says Onanuga

-

interview3 days ago

interview3 days agoNIGERIA MECHANIZED AGRO EXTENSION SERVICE PROJECT, A STRATEGIC MOVE TO ALLEVIATE POVERTY – DR. AMINU ABDULKADIR

-

brand6 days ago

brand6 days agoGTCO Plc Releases 2024 Full Year Audited Results …Pays Shareholders Record Dividend of N8.03k for 2024 Financial Year

-

news3 days ago

news3 days agoTinubu commended Nandap for her leadership, extends Comptroller-General tenure till 2026, says Onanuga

-

brand1 week ago

brand1 week agoZENITHz BANK MAINTAINS SUPERLATIVE PERFORMANCE WITH PBT OF N1.3 TRILLION IN FULL YEAR 2024